Solana Rally Faces Scrutiny as On-Chain Activity Remains Low

Despite a recent price surge, the outlook for Solana (SOL) remains uncertain due to declining on-chain activity. This raises concerns about the sustainability of the current recovery.

Solana Rebounds, But On-Chain Data Lags

Following a broader market correction, SOL’s price rebounded significantly. However, this price increase was accompanied by a substantial wave of liquidations, totalling $13.2 million, according to Coinglass. While short positions saw the larger share of liquidations, this event highlights some investor jitters.

Read Also: Ripple Heats Legal Battle with SEC, Challenges Expert Testimony

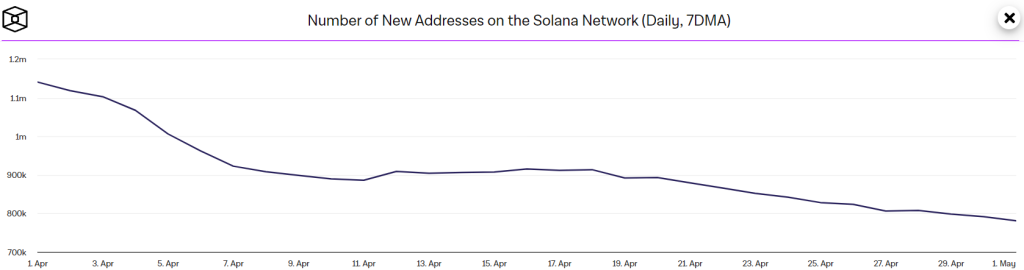

More worryingly, data from The Block reveals a concerning trend in on-chain activity. The number of new addresses on the Solana blockchain has dropped by nearly 15% over the past two weeks. This metric is often seen as a sign of network growth and user adoption. A slowdown suggests potential issues like declining developer interest, technical hurdles, or competition from other blockchains.

Active Users Also Decline, Dampening Sentiment

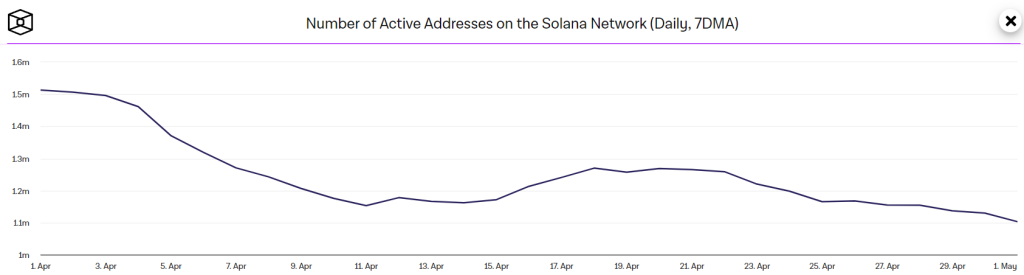

Adding to the concerns, the number of active addresses on Solana has also decreased, falling from a peak of 1.21 million to 1.1 million. This decline indicates a drop in user engagement and transaction activity, which can weaken investor confidence and potentially lower demand for SOL.

Read also: Shiba Inu Unleashes Shibarium Hard Fork for Faster Transactions and Lower Fees

Analysts Eye Resistance Levels and Potential Reversal

While the bulls managed to push the price above $120, analysts anticipate resistance around the 200-day exponential moving average (EMA) at $150. Overcoming this hurdle will require significant buying pressure. Conversely, a failure to breach this level could lead to a price reversal.

Bulls vs. Bears: A Precarious Balance

Currently, SOL is trading at $138, with some support at $116-$120. A breach of this support could trigger a sell-off, potentially driving the price down to $100.

For the bulls to regain control, they need to push the price above the 200-day EMA. This could potentially trigger a short squeeze, forcing bears to buy back their positions and accelerate the upward momentum. However, achieving this will be a challenge.

Solana’s future trajectory hinges on its ability to reignite user engagement and on-chain activity. Until then, the current price recovery remains fragile.

Follow us on Twitter, Facebook, Telegram

Tolu Zach is a multifaceted professional with expertise in both crypto content creation and medical laboratory technology. With a unique blend of analytical skills and industry knowledge, Tolu navigates the complexities of cryptocurrency while maintaining a pivotal role in healthcare. Trusted for insightful analysis and accurate diagnostics, Tolu excels in diverse fields.