Cardano’s Recent Breakout Has the Potential to Ignite a 15% Rally – ADA’s Price Prediction

Cardano (ADA) might be gearing up for a 15% surge following a significant 7% price uptick on Monday, as indicated by technical indicators and on-chain metrics. The recent price movement of the “Ethereum-killer” has led to the formation of a double-bottom technical pattern and a breakthrough above the critical $0.47 resistance level, signalling a bullish trend that is supported by escalating network activity.

Cardano’s Price is Gearing up For a Comeback

In the four-hour timeframe, Cardano’s price surpassed the $0.47 resistance level on Monday and has maintained its position above this mark. Between May 10 and 15, the Relative Strength Index (RSI) displayed a bullish divergence with the price, indicating growing bullish momentum. A move beyond the oversold territory could trigger a fresh long position.

Read Also: Shiba Inu Forecast: $SHIB Target If Spot Ethereum ETH Approved

During the first half of May, Cardano’s price reached a peak at $0.47 after rebounding from the $0.42 support level twice. This “W” shaped formation, known as a double-bottom pattern, typically suggests a potential reversal of the prevailing trend, favouring the bulls. If the bullish momentum continues and ADA manages to breach the $0.52 resistance level – a level last seen on April 22 – it could potentially rally by 15% to reach $0.60, the peak from April 11.

In case of a downturn, the Volume Profile indicator indicates that the range between $0.47 and $0.45 serves as a strong support zone, with the highest trading volume recorded at $0.xx. This area coincides with the 61.8% Fibonacci retracement level at $0.45, strengthening its position as a high probability reversal zone.

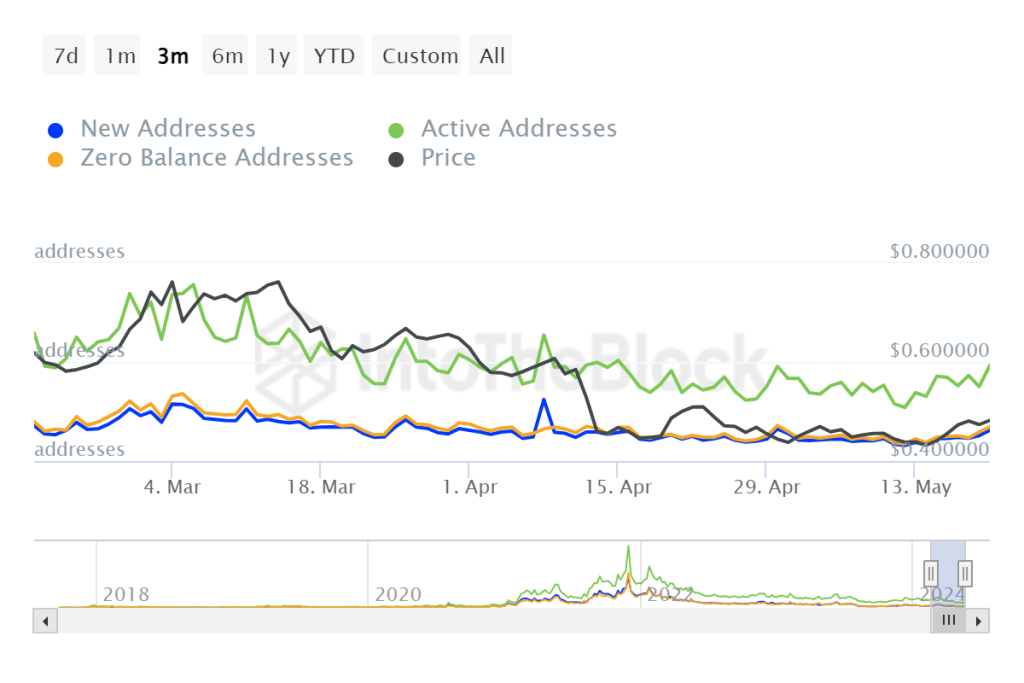

On-chain metrics for Cardano further support the bullish outlook. Data from IntoTheBlock reveals a significant increase in active addresses, rising to 38,620 on May 20 from 21,640 on May 12, indicating growing demand for Cardano.

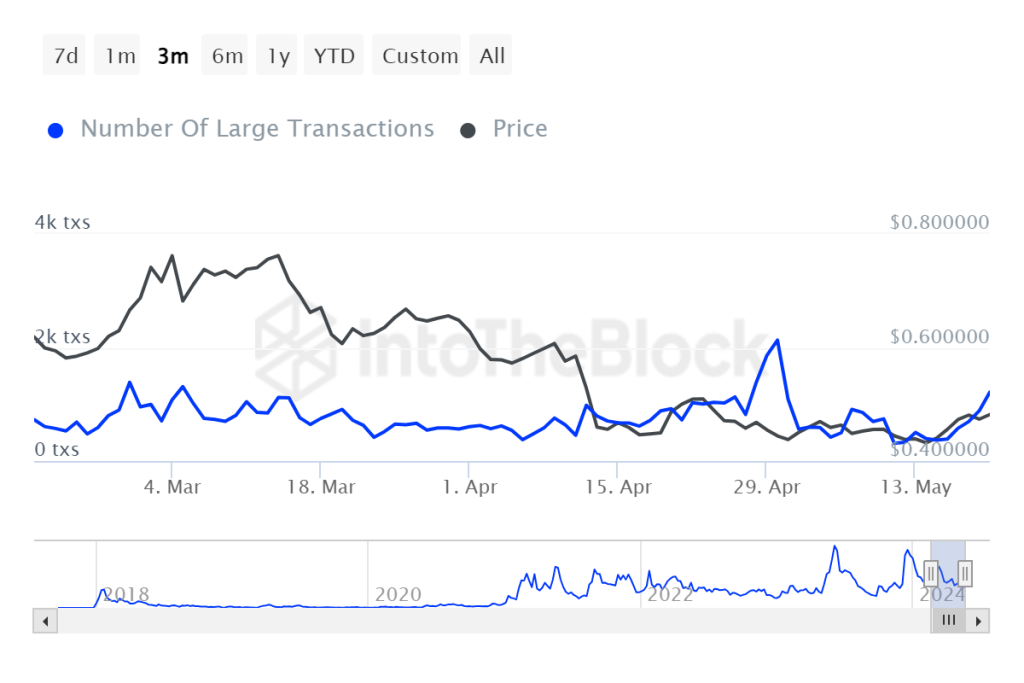

Monitoring the transactions of large-wallet investors, those dealing in amounts exceeding $100,000, can provide insights into future price movements. The surge in transactions for Cardano suggests that whales are accumulating ADA tokens.

The Large Holders Netflow offers insight into the changes in positions for investors and whales holding more than 0.1% of the supply. Netflow spikes indicate accumulation by major players, as observed in the chart below.

In spite of the robust on-chain data and technical analysis for Cardano, failure to breach the $0.52 resistance level amid a bearish overall crypto market could lead to a decline in ADA prices.

Read Also: 3 Billion XRP Traded in a Day as Price Surges by 6% – Find Out What Went Down

A daily candlestick closure for Cardano below $0.42 would result in a lower low relative to the May 15 swing low, potentially triggering a downtrend and prompting investors to sell their holdings out of fear. This would invalidate the bullish argument, leading to a 7% drop to the next key support level at $0.39, a significant barrier seen in mid-April and mid-November 2023.

Follow us on Twitter, Facebook, Telegram, and Google News.

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.