Messari’s Latest Report Shows XRP Ledger is Gaining Momentum

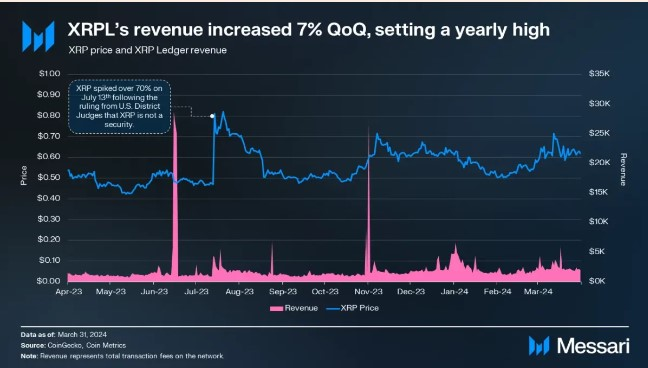

In a recent report, Messari stated that there was a rise in quarterly user demand for XRP Ledger (XRPL) between January and March. The report, titled “State of XRP Ledger Q1 2024,” revealed that demand for XRPL reached its peak for the year during this 90-day period.

Mesari’s Report On XRP

According to Messari’s report, the average number of daily addresses conducting at least one transaction on the XRPL blockchain during the first quarter was 41,000, marking a 37% increase from the previous quarter’s average of 30,000 active addresses. This surge in active addresses led to a rise in the number of transactions carried out on the XRPL network, with the average daily transactions increasing by 113% during the same period. However, there was a decrease in the number of new addresses created on XRPL during this time. Messari attributed this to the following:

“The decrease from the previous quarter is due to the exceptionally high number of addresses created in Q4 when inscription activity began. However, when looking at the annual scale, quarterly new addresses increased by 29.8% from Q1 2023 to Q1 2024. The number of deleted addresses reached 33,000, marking a 55.9% increase from the previous quarter. These deletions occurred after inscription activity ceased.”

The Impact On XRP

Despite the decrease in new addresses, this did not affect the network’s quarterly revenue. XRPL’s revenue in dollar terms reached $205,000 between January and March, marking the highest level of the year. The revenue, when valued in XRP, increased by 10.3% in the first quarter, reaching 350,000 XRP. As of now, XRP is trading at $0.52. According to CoinMarketCap data, the altcoin saw a 2% decrease in value over the last seven days.

Read Also: Shiba Inu’s Shibarium Makes Waves with 60% Surge in Key On-Chain Metric

This decline can be attributed to the steady decrease in demand from market participants. Based on Santiment’s data, the daily active addresses for the token, as observed using the seven-day moving average, decreased by 12% last week. This decrease in demand occurred alongside an increase in the daily profit/loss ratio of transaction volume during the same period. The current ratio stands at 1.34, indicating that for every losing XRP transaction, 1.34 transactions resulted in profit.

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.