Dogecoin Breaks Through Key Resistance at $0.111 With 5% Increase, Paving the Way to $0.150

Dogecoin, the primary meme coin in the market, has encountered a significant surge in price, surpassing the critical threshold of $0.111. Within the preceding 24 hours, DOGE has exhibited a gain of over 5%, reaching an intraday high of $0.116.

This price movement suggests potential bullish momentum. However, it is imperative for DOGE to maintain its position above the $0.111 level in order to confirm a sustained upward trend.

Market Trend Analysis and Performance

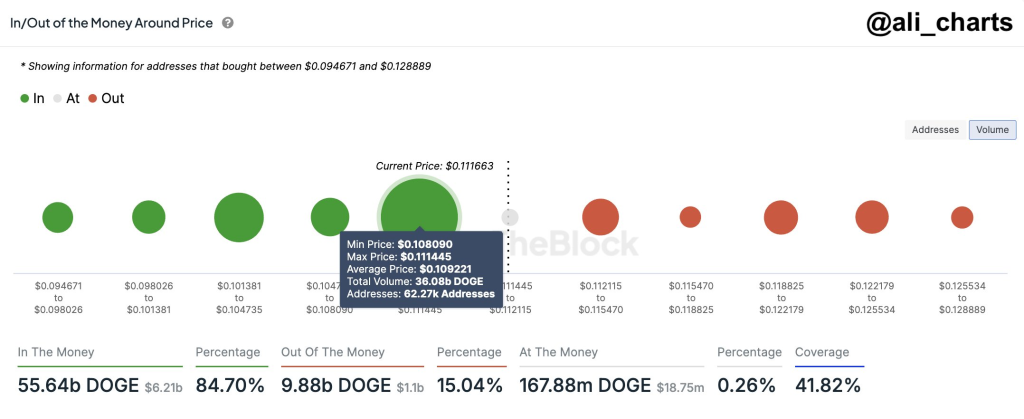

Analyst Ali Martinez recently disseminated market data shedding light on the distribution of Dogecoin holdings within the present market. More than 36 billion DOGE is collectively held by approximately 62,270 addresses, with acquisition prices ranging between $0.108090 and $0.111445. The average acquisition price for these holders is $0.109221, positioning them at a profit.

Further analysis reveals that approximately 84.70% of DOGE holders are currently in a profitable position, holding 55.64 billion DOGE valued at approximately $6.21 billion, acquired at prices between $0.094671 and $0.109221. This data indicates that the majority of holders purchased DOGE below the current market price. Conversely, about 15.04% of holders, owning 9.88 billion DOGE worth $1.1 billion, are at a loss due to acquiring DOGE at higher price points.

Maintaining the current price level is crucial as it ensures that the majority of holders remain profitable. Sustaining this threshold could further strengthen market confidence.

Upward Momentum

Martinez’s analysis suggests minimal resistance for DOGE, given that most holders acquired their tokens at lower prices. This implies that upward momentum may encounter fewer supply barriers, potentially leading to further price increases. According to the analyst, the absence of significant resistance above the current price may allow DOGE to target the $0.150 mark if the current bullish sentiment continues.

As per IntoTheBlock data shows that recent inflows from large holders contribute to the potential upward momentum for Dogecoin. While there has been a short-term increase of 24.03% in inflows, longer-term trends display mixed signals, with a 30-day inflow change down by 73.06% and a slightly negative 90-day change at -5.88%.

A report from September 19 indicated that Dogecoin broke above a descending trendline, signalling a potential shift in market sentiment. At that time, Dogecoin’s price was near the 78.6% Fibonacci level at $0.10067, which acted as a support zone. Dogecoin has continued its upward trend, Martinez predicts that a confirmed breakout could significantly drive the price to $0.150, provided the recently reclaimed resistance at $0.111 holds.

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.