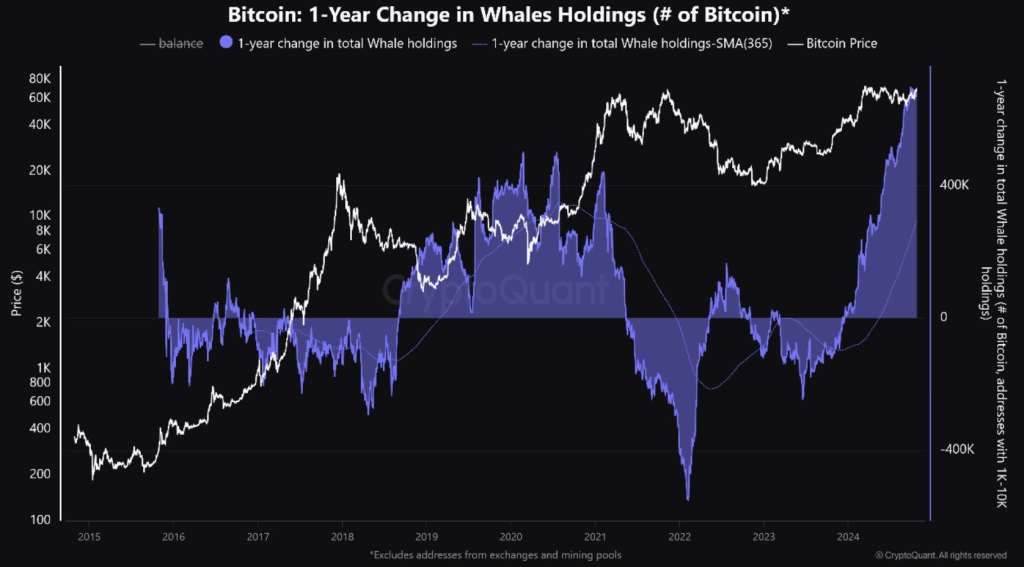

Bitcoin Whale Holdings Reach Record High of 670,000 BTC, Could This Signal The End of BTC’s Correction?

After finding support at the $65,500 level, Bitcoin’s (BTC) price has rebounded to over $68,000 today, coinciding with record high whale holdings. In the past fortnight, the cohort of whale wallets those holding larger amounts of BTC has increased by 297, reflecting enhanced confidence in the asset and suggesting that the recent correction may be behind us.

Bitcoin Whale Wallets Surge

Currently, whale holdings have reached an unprecedented 670,000 BTC. This could indicate a renewed wave of market optimism among investors. Crypto analytics firm CryptoQuant notes that historically, when BTC whale holdings trend positive, the price often experiences moderate declines or sideways movement. This dynamic suggests a potential lull before a more significant market shift occurs. They state, “The real surge in Bitcoin growth typically begins when whales begin to offload their holdings, leading to negative percentage changes.”

Read Also: Ripple Takes Bold Step Files Form C for Cross Appeal in Ongoing SEC Showdown

Additionally, Santiment corroborated that 297 new Bitcoin whale wallets, each holding over a certain threshold, emerged in the last two weeks. Conversely, the number of wallets with smaller holdings has decreased by 20,629, indicating consolidation among larger holders following the recent panic selling from retail investors—often a precursor to bullish market behavior.

On a positive note, ETF inflows remain robust, with BlackRock’s Bitcoin ETF leading in accumulation. Over nine consecutive trading sessions, BlackRock’s IBIT has acquired nearly 30,000 BTC, now representing over 2% of the total circulating supply with 399,355 BTC.

Is the BTC Correction Complete?

Following a price rejection at the $69,000 mark, retail sentiment has turned cautious regarding upcoming BTC movements. While Bitcoin is recovering to reclaim lost territory, it must surpass $69,000 to establish a sustained uptrend.

Despite the promising uptick in whale wallets, CryptoQuant cautions that if Bitcoin does not set a new all-time high by around the upcoming U.S. presidential elections specifically by November 28 ±21 days it might signal substantial issues for the ongoing bull cycle.

Moreover, crypto analyst Justin Bennett points out that during bullish phases, Bitcoin rarely offers reset opportunities as observed currently. Investors should stay alert to forthcoming developments as they consider positioning in Bitcoin.

Read Also: Cardano Founder Took a Stand Against Ripple Co-Founder Chris Larsen

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.