Comparing Centralized And Decentralized Crypto Exchanges (Advantages & Disadvantages)

Centralized crypto exchanges are platforms that permit users to purchase and sell cryptos within an infrastructure managed by the exchanged firm. We have vouched to get the information that you have been seeking and have presented them to you in plain and simple language for your maximum understanding.

What is Crypto Exchange?

A crypto exchange is an online platform for buying and selling digital currencies. It is an online platform that allows traders to buy, swap, invest, convert, sell and transfer their cryptocurrencies from one wallet address to another. Added to this, an exchange has several other features and services it renders to traders.

Read Also: Top 12 Solana NFT Marketplaces

The most significant feature of this is that; it permits traders to exchange their fiat money for crypto and vice versa. Therefore, without an exchange, it may be hard to convert crypto to fiat money, especially in those countries where crypto has not been legalized. The services offered by a crypto exchange are very much similar to those of brokers. This is because the crypto exchange bridges the gap between the trader and the crypto market, just like brokers do in the forex market.

Primary Functions of an Exchange

The functions that the exchanges perform for crypto traders are so numerous. Without a crypto exchange, it might be hard to purchase and sell crypto or even exchange it for fiat money.

Below are the few importances and functions of the exchange/.

- Linking buyers to sellers: The general purpose of an exchange is to provide liquidity for buying and selling crypto. Without an exchange, it will be very difficult to convert crypto into fiat money.

Executing Market orders: CEX makes it easy for traders to place orders same or different at the market, to be executed at a later moment when the price gets to such points. To this end, all the exchanges today could be regarded as crypto brokers as they bridge the gap between the individual and the crypto market.

Listing new Cryptocurrencies: CEX generally brought about new cryptocurrencies to the knowledge of the investors, without the exchange, it will be difficult to launch a new crypto project.

- Storage Medium: Often some investors use an exchange as a storage place for their crypto assets. Some buy and hold crypto for the long term through an exchange.

- Easy Payments using Crypto: The majority of the exchange today, for example, the Binance, have added an extra feature to their exchange that makes it feasible for traders to purchase products outside the exchange using crypto.

Types of Crypto Exchanges

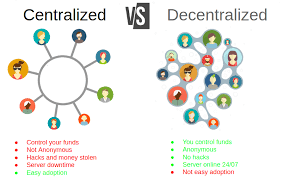

There are two main types of Crypto exchange. They are Centralized and Decentralized crypto exchanges. Other forms found today include a modification or crossbreeding of the two main types of exchange:

Centralized Exchange

A centralized exchange is the type of exchange that is built on a Central Server. All activities on the server are therefore monitored and controlled by the owners. This type of exchange is often regulated. This means users of the platforms can be traced in cases of fraud and misconduct. Hence, centralized exchange always requires its users to complete an identity verification process known as ‘Know-Your-Customer’ (KYC) before they are given full access to use the platform. Above all, CEX enables users to exchange cryptocurrencies easily into fiat money and vice versa.

List of Top Centralized Exchanges

- Binance

- Coinbase

- Kraken

- Bitfinex

Centralized Exchange Advantages

- High security for assets: Centralized Crypto Exchange provides strong security for investors’ funds when it comes to buying and selling cryptocurrencies on their platform. This is often achieved through the identity verification process carried out on registrations. Thus, buyers and sellers are no longer faceless beings or ghosts but traceable merchants.

- Strong Liquidity: Centralized exchanges often provide high liquidity for buying and selling crypto. This makes it possible to exchange crypto fairly at the desired price without much slippage.

- Regulated: Most centralized exchanges are registered with the relevant financial authorities in the countries where they operate. This implies investors can also trace the owners of the exchange via regulatory agencies should they ever abscond with the investors’ assets.

- User-Friendly and Support System: Most centralized exchanges always make their platforms very easy to use; by making provision for a simple guide to users on how to ruminate their platforms. Equally, the CEX provide 24/7 customer support service channels to address various issues and complaints from their clients.

Centralized Exchange Disadvantages

- Prone to security breaches: The fact that centralized exchanges use a hot wallet to enable their users to gain access to their platform has made them susceptible to attacks from hackers. Many criminals today now target the large volume of funds traded in centralized exchange as a good place to rob.

- Commissions are charged for each transaction: Very often, most centralized exchanges charge some commissions for using their platforms.

Decentralized Exchange

A decentralized exchange is grossly unregulated. There is no control over the user’s actions. Many traders today prefer to carry out large volumes of crypto transactions without ever revealing their identity, and making it feasible to trace them. This is just how DEX serves this set of people. Therefore, it is a crypto exchange medium where all transactions are conducted anonymously without a trace of their dealers.

- Uniswap (ETH)

- Pancakeswap (BNB Chain)

- Raydium (Solana)

- QuickSwap (Polygon)

Decentralized Crypto Exchange Advantages

- Helps to hide the identity of the users: Using a decentralized exchange gives the traders the kind of privacy they desire while carrying out their financial transactions. Most investors and big institutions use the decentralized exchange to hide their net worth to escape government taxation.

- Gives users total control over their assets, there is no central body that controls the DEX. Therefore, users have full control over their assets and can decide what to do with them. The cases of hacking are highly minimized while using the decentralized exchange.

- Enhances to surmount govt. sanctions; very frequently, users from those countries where cryptocurrency trading is prohibited by the govt.; consider the DEX as the best way to overcome those government sanctions. This is because it is very hard for the government to penetrate it.

Decentralized Crypto Exchange Disadvantages

The following are the disadvantages associated with using a decentralized crypto exchange:

- Does not allow the exchange of Fiat Currency:

It is not possible to exchange crypto for fiat money using a decentralized exchange. Doing so, no doubt will reveal the identity of the receiver

- Highly Vulnerable:

The founders of the decentralized exchange are known to users. this makes all crypto transfers via them very liable to lose as the anonymous owners can easily abscond with them. Unfortunately, there is no way to trace them.

- There is no one to complain to in cases of failed transactions:

All transactions carried out on the decentralized exchange are at the owner’s risk. No one is available to assist new users or resolve failed transactions.

Factors to consider while choosing an Exchange

Regulation: Every country has a financial authority regulating all brokers offering financial services in their country. Only those exchanges that have fulfilled the demands of these regulatory bodies are recommended for traders today.

- Multiple options for Deposit and Withdrawal: Provision of multiple options for deposit and withdrawals such as Bank wire, Skrill, Neteller, Debit and Credit cards, Crypto, etc. are important considerations in choosing an exchange.

- Ease of Withdrawal: The number of days it takes to receive funds from an exchange is very crucial in making decisions on which exchange to pick. Good exchanges complete withdrawal orders within 24 hours.

- The number of tokens supported: Providing an extensive number of cryptocurrencies attracts more investors to exchange. This increases the volume traded daily on such exchanges too.

- Presence of Peer-to-Peer trading platforms: An inclusion of P2P trading platforms is very necessary, especially for those countries where the banks are prohibited from facilitating Cryptocurrency transactions.

Read Also: A Simple A-Z Guide for Starters On STEPN (GMT)?

- Commissions charged: Good exchanges charge lower commissions for using their platforms.

- Customer Support Services: The availability of efficient customer support services to attend to a client’s needs is a very essential service required in every crypto exchange today.

- User review: One needs to go visit various expository websites to see the remarks that past and existing users have made about the exchange.

- Years of experience: One should choose only brokers that have proved themselves tested and validated via their long years of excellent service delivery.

- Global Presence: Best cryptocurrency exchanges existing today are known to have their branches and presence across other countries and are not confined to one’s country only.

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.