Cardano Gained A 127% Profit With A TVL Growth Of 645%

The Cardano remarkable performance was made known by Messari who made available a report about the situation towards the end of the last quarter of 2023. The report features positive metrics across different areas for Cardano, including ADA’s price, total worth locked, and stablecoin valuation.

State of @Cardano Q4

Key Update: Ecosystem growth came from both more established protocols like @MinswapDEX and newer ones like @Indigo_protocol.

QoQ Metrics 📊

– TVL ⬆️ 166%

– Stablecoin value ⬆️ 37%

– ADA ⬆️ 127%Read the report for free 👇https://t.co/TVAdEwlY5p pic.twitter.com/rGZlYnWiyp

— Messari (@MessariCrypto) February 14, 2024

Messari mentioned that Cardano is a seven-year standing proof-of-stake blockchain featuring smart contract capacities, giving dApps scalability, security, and sustainability.

Read Also: Cardano Welcomes A Remarkable Number Of Smart Contract After Poor ADA Performance

145.2% YoY Profit

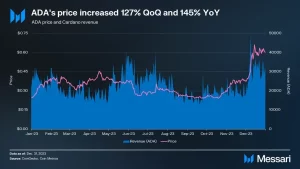

According to the report, Cardano enrolled a quarter-over-quarter (QoQ) development of 127.2%, which outperformed the general market’s 53.8% increment. This fourth-quarter rise raised ADA’s year-over-year (YoY) change to 145.2%.

Besides, the report featured that network income in dollars encountered a 66.7% QoQ increment.

In any case, it brought up that this growth was not exclusively owing to ADA’s price movement, as income in ADA tokens likewise saw a 10.6% QoQ increment.

Prominently, Cardano’s Treasury balance increased by 2.6% from the past quarter to arrive at 1.43 billion ADA. The report witnessed that the 40 million ADA increase commonly lined up with development patterns from preceding quarters.

Moreover, it featured that 20% of all transaction fees are assigned to the treasury.

In the meantime, Messari unveiled that the average transaction expense in dollars increased by 50.4% from the former quarter, ascending from $0.10 to $0.15. Alternately, the typical transaction charge in ADA stayed unaltered QoQ.

The report proposed that the discrepancy shows that the ADA’s price movement was to a great extent responsible for the upsurge denominated in USD.

Read Also: Cardano Stands Out Over Ethereum, Solana: Top Analyst

Total Value To 645%

Then again, Messari accentuated that Cardano experienced massive growth inside its ecosystem during Q4 2023.

Specifically, it referred to that total value locked (TVL) in USD surged by 166% quarter-over-quarter and 693% year-over-year. During the fourth quarter exercises, Indigo outperformed Minswap becoming the leading protocol by TVL.

In addition, the report uncovered that stablecoin TVL flooded by 37% compared with the past quarter and increased by 673% since Q4 of 2022.

Also, Messari talks about the ongoing improvement of scaling infrastructure like Mithril and Hydra. In the interim, tools like Paima Engine, live on the mainnet, saw supported adoption among developers.

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.