What Factors Influence XRP’s Price After a 92% Volume Surge?

Over the past 24 hours, Ripple’s XRP token has experienced a significant surge in trading volume, reaching 92.36% growth and totaling at $4.8 billion according to CoinMarketCap’s data. This increase in volume was accompanied by a rise in XRP’s price, which has grown by 9.2% since April 4th.

Read Also: Crypto Revolution: Ripple CEO Anticipates Market Cap Explosion to Surpass Apple and Nvidia

A massive Rise in volume

However, while this recent price movement may seem positive, it is important to consider the broader trend for XRP. After testing the $0.7440 level on March 11th, XRP’s price has declined significantly, exhibiting multiple lower lows and lower highs and establishing a bearish trend. Even with the recent surge in price, it is unlikely to reverse this trend.

Despite this, the Chaikin Money Flow (CMF) for XRP has experienced a notable increase in the past few days, reaching 0.17. This suggests a significant influx of buying pressure in the market for XRP. Additionally, the Relative Strength Index (RSI) has fallen to 54.13, indicating that while the momentum may not be as strong as during overbought conditions, some upward momentum can still be expected.

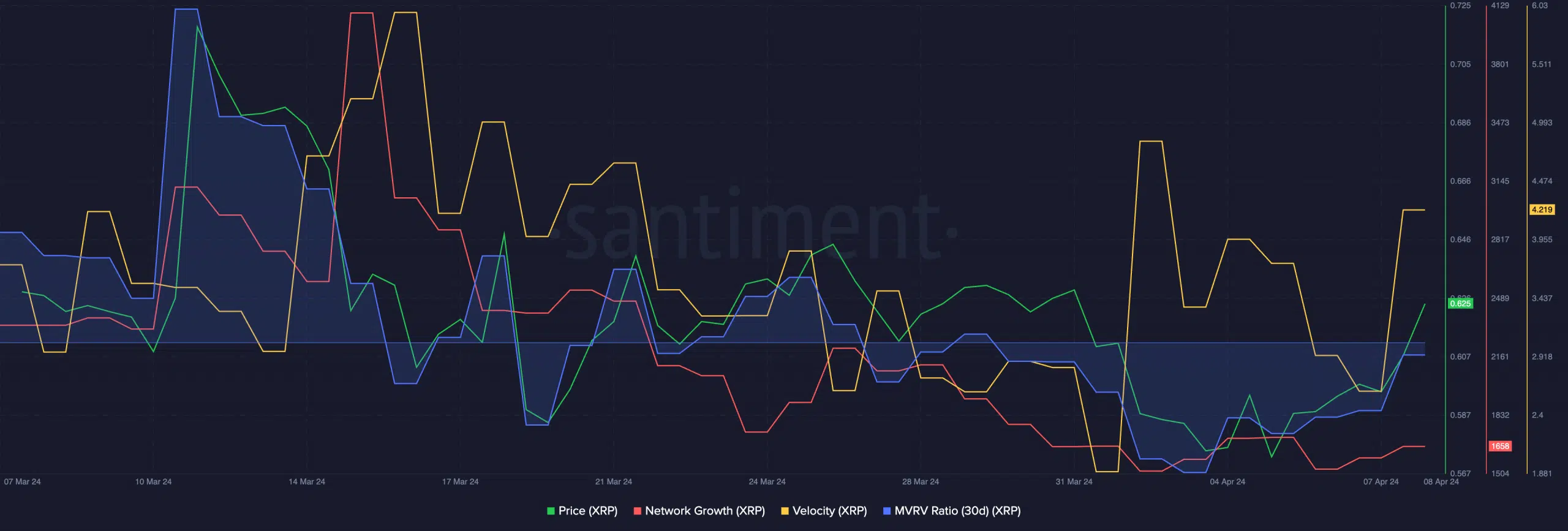

If XRP manages to surpass the $0.6646 level, it may see a reversal in trend and aim for the $0.7440 level going forward. However, there are several challenges XRP must overcome before rallying again. Santiment’s data analysis by AMBCrypto revealed that the network growth for XRP had declined materially over the last few days, indicating a loss of interest by new addresses.

The Overview of the Specificity

Yet, some positive signs remain. The velocity around XRP has grown significantly in the last few days, implying that the frequency at which XRP was trading had increased. Additionally, XRP’s declining MVRV ratio is another positive sign, indicating that most addresses holding XRP were not profitable. While this may seem concerning, it is actually a sign that holders are incentivized to wait until XRP’s price sees green before selling, reducing the selling pressure on the token.

Follow us on Twitter, Facebook, Telegram, and Google News.

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.