Cardano On-Chain Metrics Signal Bullish Turn Despite Investor Losses

Cardano (ADA) investors have been experiencing a rough April, with most selling their holdings at a loss. However, on-chain metrics are flashing buy signals, suggesting a potential price upswing despite the current bearish sentiment.

Selling Pressure Lessens as Underwater Investors Hold On

Data from IntoTheBlock’s Global In/Out of the Money (GIOM) indicator reveals a key trend. While nearly 60% of wallet addresses are currently underwater on their ADA holdings, meaning they would incur a loss if they sold now, this situation might be stabilizing. The indicator shows that only 40.10% of addresses are currently profitable.

Read Also: Terra Classic Community Rejects Gas Fee Hike, LUNC Price Takes a Hit

This dynamic creates a scenario where further selling is less likely. Investors who are already losing money are less incentivized to sell, potentially creating a buying opportunity for those waiting on the sidelines.

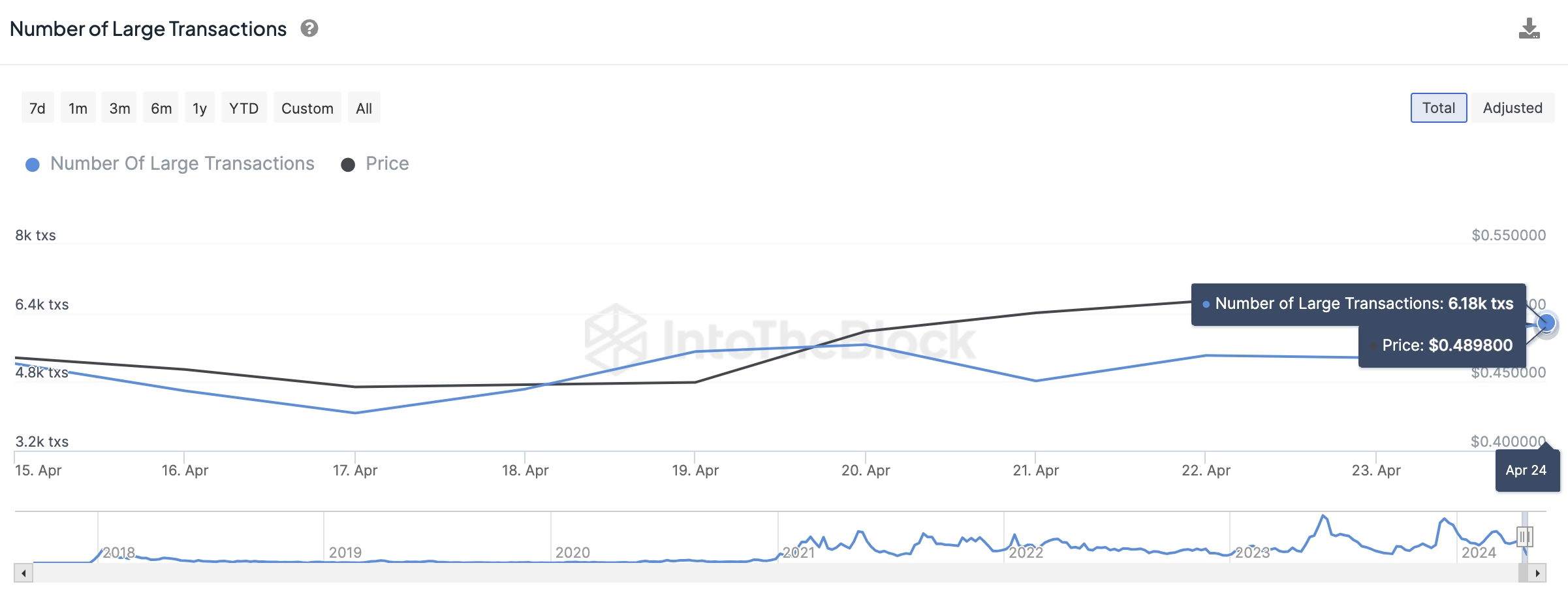

Whale Activity Hints at Accumulation

Another interesting signal comes from large transaction data. The number of transactions exceeding $100,000 on the Cardano blockchain, often indicative of whale activity, jumped 15% on April 24th. This increase happened despite a nearly 4% drop in ADA price on the same day. This suggests that large investors might be “buying the dip,” accumulating ADA at its current price point.

Capitulation Event May Signal Buying Opportunity

Santiment’s Network Realized Profit/Loss metric adds another layer to the story. This metric tracks the overall profit or loss across all ADA transactions within a specific timeframe. When analyzed alongside price movements, it reflects market sentiment and capital flow.

Read Also: Robinhood Opens Up Shiba Inu, Avalanche, and Compound Trading for New York Residents

In Cardano’s case, the metric suggests a recent capitulation event, where investors may have sold out of their positions at a loss. This capitulation, however, can be a contrarian indicator, historically signalling potential buying opportunities.

%20[18.44.54,%2025%20Apr,%202024]-638496551564631785.png)

Cardano’s Price Outlook

While Cardano is currently trading slightly down at $0.4679, on-chain metrics suggest a potential bullish reversal. With less selling pressure from underwater investors and possible whale accumulation, the future might be brighter for ADA. However, it’s important to remember that the cryptocurrency market remains volatile, and investors should always conduct their research before making any investment decisions.

Follow us on Twitter, Facebook, Telegram

Dr. Olajide Samuel juggles the demands of medical studies with a passion for cryptocurrency. A seasoned blogger, Olajide shares his vast global knowledge of the crypto space, offering insights to enthusiasts. Despite his busy schedule, his commitment to crypto remains strong, and he actively seeks ways to contribute to its future.