Analyst Claims JPMorgan’s Cross-Border Payments Could Catapult XRP to $1,000

Over the years, multiple payment entities have taken notice of the utility of a certain technology. Ripple and its digital asset, XRP, have been mentioned in a JPMorgan report as entities that could help unlock around $120 billion trapped in cross-border payments. The Crypto Basic has also highlighted XRP as a potential alternative to SWIFT in cross-border settlements, while The American Institute of Physics, the IMF, and the World Bank have all spotlighted XRP’s utility in cross-border payments in different reports.

Overview of XRP’s Utility in Cross-Border Payments

Interestingly, SEC Chair Gary Gensler had previously acknowledged XRP’s advantages for use in cross-border payments over traditional fiat currencies. With this utility recognized by the general public, investors believe that XRP is undervalued and are projecting an imminent price explosion, especially with the expected growth in the cross-border payment sector. Ripple noted in its 2023 New Value Report that the cross-border payment sector could witness a $250 trillion in volume in the next three years, citing the Bank of England.

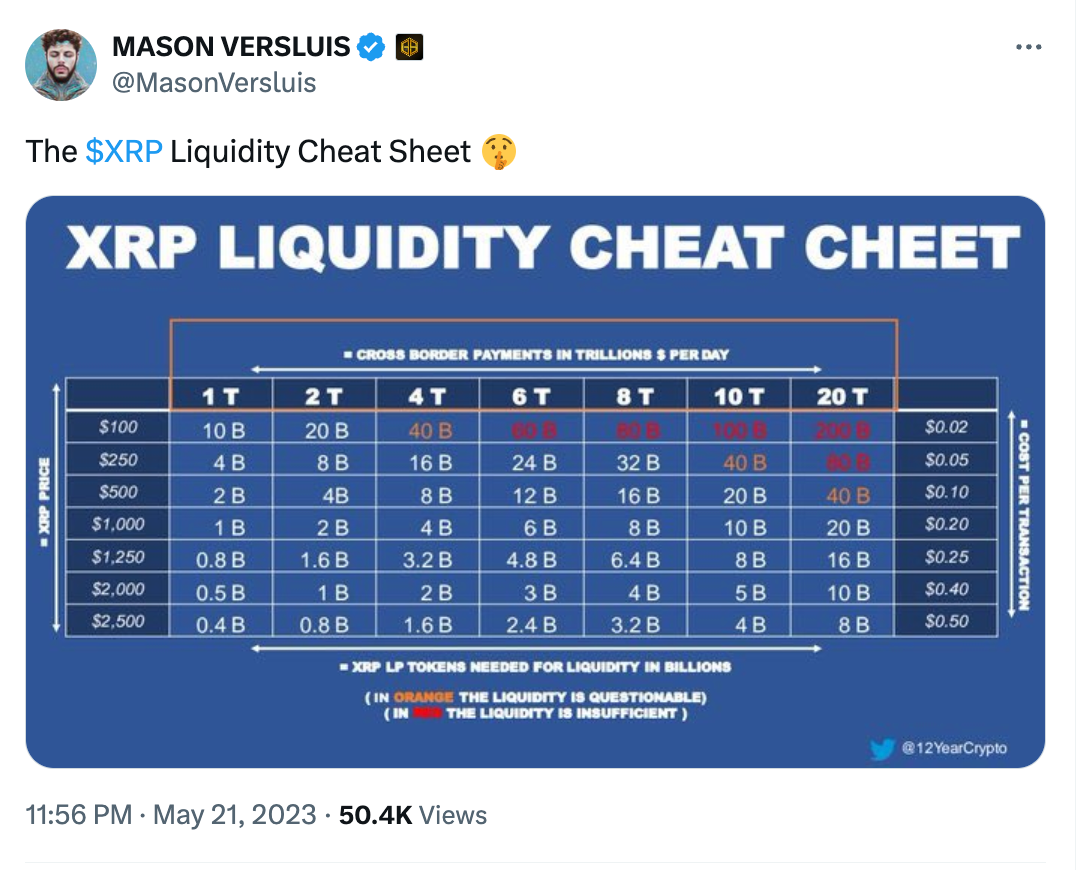

As this projection is expected to materialize, pundits argue that XRP would need to soar way beyond its current price below $1 if it captures even a fraction of this volume. A market analyst, going by the Twitter (X) pseudonym Mason Versluis, recently called the XRP community’s attention to a document that lends credence to the lofty price target.

Read Also: Ripple Moves Over 1 Billion XRP, Locks Back 800 Million in Escrow

An Argument for a $1,000 XRP Price

In the sheet, the analysis evaluates trading liquidity needed for XRP to cater to different daily cross-border payment volumes. At prices ranging from $100 to $500, XRP could sufficiently handle daily payment volumes from $1 trillion, but these prices become less feasible at volumes from $6 trillion to $20 trillion. This is because XRP’s circulating supply of 55 billion would not be sufficient for the amount of XRP tokens needed to handle these volumes.

Finance pundit Shannon Thorpe previously argued that XRP would be undervalued at $500 if it locked in a portion of the projected $250 trillion cross-border payment volume. Versluis’s sheet proposes that XRP would only sufficiently address daily payment volumes ranging from $1 trillion to $20 trillion if its price is at least $1,000. At a $1,000 price, the market would need to move 1 billion XRP tokens to account for a $1 trillion volume and 20 billion tokens for a $20 trillion volume.

From the 2023 New Value Report by #Ripple

$250T is expected by 2027 just in cross-border payments!

A $500 XRP price just doesn't seem like enough to facilitate that amount. 😉 $xrp #xrpisnotasecurity pic.twitter.com/HvIIp0vIiD

— Shannon Thorp (@thorpshannon87) September 11, 2023

Rrad Also: Breaking Records: PEPE, WIF, POPCAT Lead the Explosive Growth of Meme Coins

For XRP to clinch a $1,000 price, it would need to skyrocket by a massive 188,543% from its current value of $0.5301. With this price potentially pushing XRP’s market cap to an unimaginable $55 trillion, some industry commentators have strongly expressed doubts. Moreover, some have pointed out that a $1 trillion daily cross-border volume is a difficult task for XRP over the next ten years and beyond. For context, the entire global cross-border volume stood at $150 trillion in 2022, representing an average of $410 billion volume per day. Achieving a $1 trillion volume would be more than double this figure.

Follow us on Twitter, Facebook, Telegram, and Google News.

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.