Solana’s Price Projection: SOL Sets Sights on $180 Revisit as Bulls Execute $180M Maneuver

On June 4, 2024, Solana’s price surged above $165, marking a 4% increase over the past 3 days. This upward trend is supported by a significant increase in long positions, indicating the potential for further gains.

Solana Price Reverse Last Week’s Losses

The rise in Solana’s price comes after a period of struggle in late May, during which the approval of the spot ETH ETF led to a shift in investor focus and capital towards Ethereum DeFi and spot markets. As the initial excitement surrounding the ETF approval subsides, there has been renewed interest in Solana since the beginning of June.

Read Also: Shiba Inu Dev Kusama Departs Middle East After Cultural Immersion Trip

Analyzing the daily price chart on TradingView, we observe that SOL price has risen from $161 on June 1 to establish a stable support level above $165 as of June 4.

The sustained 4% surge over the last 72 hours signals a resurgence in bullish momentum in the SOL markets following the diversion of capital towards the Ethereum ecosystem due to the ETF approval.

Traders Deploy $150M Leverage as Bullish Momentum Returns

A key indicator of the growing bullish sentiment in Solana markets is the notable increase in long leverage positions by speculative traders this week.

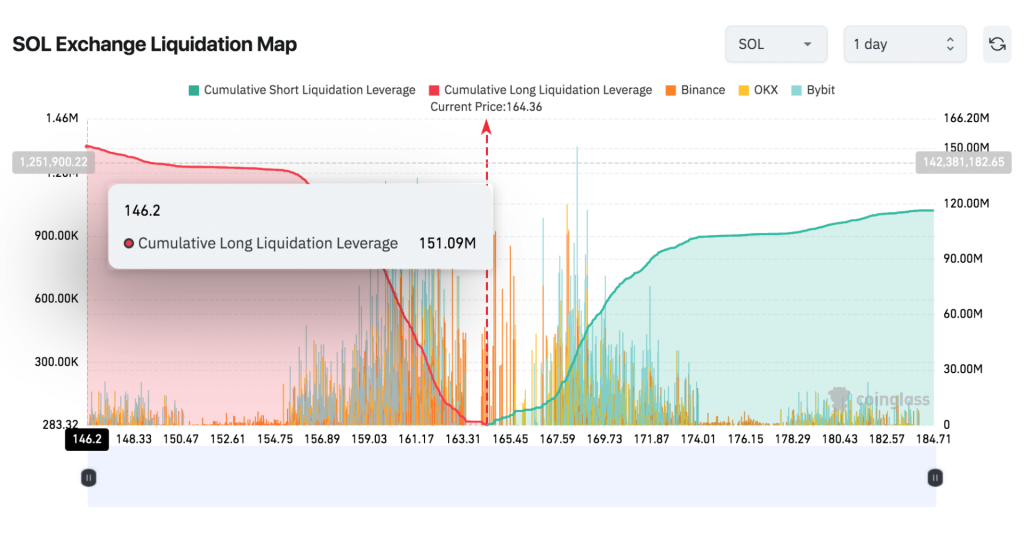

According to Coinglass‘ Liquidation map data, the influx of long positions has significantly outnumbered short contracts in Solana futures markets. Bullish traders have deployed $151.09 million in long positions with the 20% boundaries of the current prices, while the total volume of short contracts stands at $110 million. This significant imbalance indicates that bullish traders are taking more aggressive positions, showing growing confidence in the potential for further price increases.

With Solana’s price currently at $165, a potential breakout towards $180 could be on the horizon. Conversely, should the market experience another downtrend, SOL price is likely to find substantial short-term support around the $155 level. The majority of the $150 million leverage contracts are listed between $164 and $154, highlighting the potential for significant demand within this range as bullish traders aim to avoid major liquidations.

Read Also: DOGE Miners’ $200M Buying Spree Unveiled, Despite 9% Dip

Follow us on Twitter, Facebook, Telegram, and Google News

Michael Onche: Crypto aficionado and seasoned analyst. With a keen eye for market trends and a passion for blockchain technology, he deciphers the intricacies of cryptocurrency with precision. Michael’s expertise and insightful content make him a trusted guide for navigating the dynamic world of digital assets.