Terra Classic Price: Crash, Support, and Events to Watch

Terra Classic (LUNC) has been caught in the crossfire of a recent market-wide crash, experiencing a 19% drop on June 8th. This significant price decline comes just ahead of a crucial week for LUNC, with potential events impacting its price movement.

Read Also: China Crypto Rumor: Undervalued Coins or Speculative Frenzy?

Technical Analysis Paints a Bleak Picture

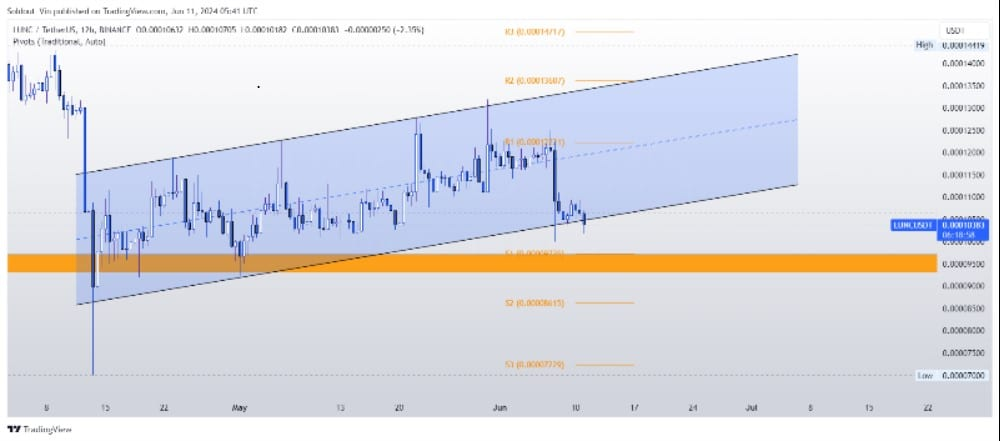

Looking at the charts, the news for LUNC isn’t great in the short term. The price is currently trading around $0.0001038, down 3.2% in the last 24 hours and 11.8% in the past week. This recent drop follows a break from a 56-day ascending channel, indicating a potential shift in momentum.

Zooming out, LUNC has been trapped in a large, 197-day descending triangle pattern. As the price approaches the end of this pattern, uncertainty surrounds its future direction. Adding to the bearish sentiment, LUNC is trading below both its 50-day and 200-day Simple Moving Averages (SMAs).

The Fibonacci retracement tool suggests further downside for LUNC, potentially reaching $0.00009320. However, this price point coincides with a strong support zone that has held for several months. A drop to this level could trigger buying activity from investors seeking a bargain.

Read Also: BONE Goes Mobile: Millions of Atomic Wallet Users Gain Access to Shiba Inu’s Ecosystem Token

On the flip side, if the price manages to reverse its current trend, it might encounter resistance around $0.0001221, $0.0001360, and $0.0001471.

Bullish Fundamentals on the Horizon

Despite the bearish technical outlook, some upcoming events could inject bullish sentiment into the LUNC market.

Firstly, Binance Thailand is listing LUNC and USTC on June 11th. This opens the Thai market to LUNC investors, potentially increasing trading volume and boosting the price. The LUNC community is also planning a celebratory event to mark this listing.

Secondly, on June 12th, the outcome of the SEC’s lawsuit against Terraform Labs (TFL) might be revealed. A favourable settlement could trigger a price surge for LUNC. However, this potential positive development coincides with the FOMC meeting, where interest rate decisions might introduce volatility and potentially dampen any gains from the court case.

The Verdict: A Week of High Anticipation

LUNC investors are holding their breath for June 12th. A positive outcome in the TFL case could be a major catalyst for LUNC’s price. However, the overall market sentiment and FOMC decisions will also play a significant role in determining the direction of LUNC in the coming days.

Follow us on Twitter, Facebook, Telegram, and Google News

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.