Terra Classic (LUNC): A Look Back and a Speculative Leap Forward

Terra Classic (LUNC), formerly known as Terra (LUNA), has endured a tumultuous year. Following the dramatic collapse of its sister stablecoin TerraUSD (UST) in May 2022, LUNC’s price plummeted. However, a dedicated community and ongoing token burns are fueling cautious optimism about its future. Let’s delve into LUNC’s past, explore current market trends, and examine price predictions for the coming years.

Terra Classic: A Blockchain Built for Payments

Terra Classic is a blockchain protocol designed for global payments using stablecoins. It utilizes a proof-of-stake consensus mechanism, with LUNC serving as its native token. Originally launched as Terra (LUNA), the project rebranded after the UST crash, separating itself from the new Terra 2.0 blockchain.

Read Also: Shiba Inu: Whale Accumulation Hints at Recovery on the Horizon?

From Meteoric Rise to Devastating Fall

LUNC’s journey has been one of extremes. It reached a peak of over $119 in April 2022, only to experience a catastrophic decline following the UST de-pegging. Since then, LUNC has struggled to regain its footing.

Community Efforts and Token Burns: A Path to Revival?

The Terra Classic community is actively working on reviving the project. One key strategy involves token burns, which aim to reduce supply and potentially increase value. Recent data showcases significant daily burn activity, with over 123 billion LUNC burned at the time of writing.

Market Trends Paint a Mixed Picture

LUNC’s recent price performance reflects the broader crypto market’s volatility. Over the past month, it has experienced a decline, mirroring trends observed in major assets like Bitcoin (BTC) and Ethereum (ETH). This suggests that LUNC’s price movements may be partially influenced by overall market sentiment and macroeconomic factors.

Read Also: Osmosis Zone Unleashes Cross-Chain NFT Staking with Enterprise DAO

Terra Classic Price Predictions: A Range of Possibilities

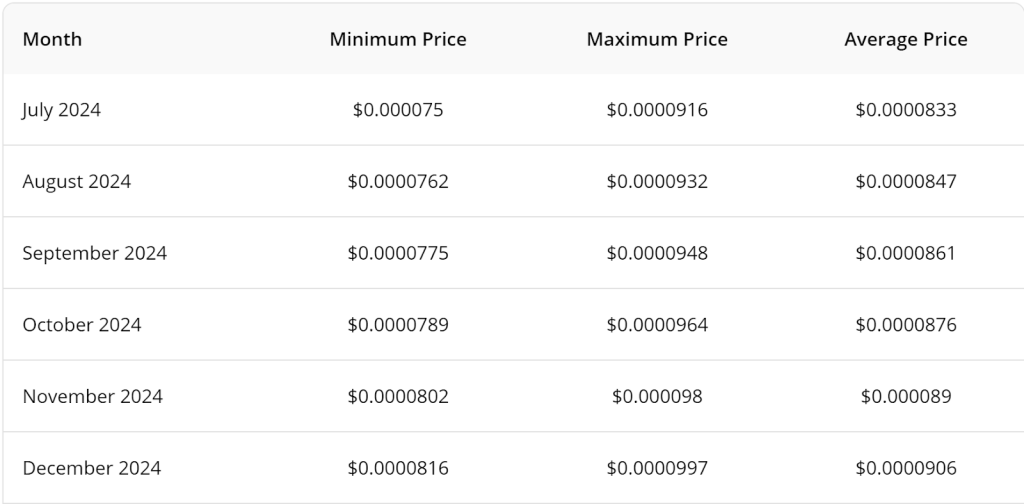

While some optimistic forecasts suggest LUNC could reach $1 shortly, most analysts paint a more conservative picture. Here’s a glimpse into various predictions for the coming years:

- Short-Term (2024): Reaching $1 seems unlikely in the immediate future. CoinCodex predicts a potential 10.71% rise by July’s end, reaching $0.00008987. Traders Union offers a similar range between $0.000075 and $0.0000916 for July.

- Mid-Term (2025): CoinCodex anticipates LUNC to break $0.000215 by 2025, while Traders Union forecasts an average price of $0.00010026 by mid-2025 and $0.00011091 by year-end.

- Long-Term (2026-2040): Predictions across different platforms vary significantly. CoinCodex expects LUNC to oscillate between $0.00006182 and $0.000242 by 2026, while PricePrediction offers a more bullish outlook, with an average price of $0.000324 by 2026. Forecasts for the later years range from $0.00006182 (CoinCodex) to a high of $0.1334 (PricePrediction) by 2040.

Is LUNC a Good Investment? A Call for Careful Consideration

The potential for significant returns exists with LUNC, but its future remains highly speculative. The next few years will be crucial, with factors like community support, token burns, regulatory changes, and market sentiment playing a vital role.

Investing in LUNC involves inherent risks. Investors should conduct thorough research, understand the associated risks, and consult with financial professionals before making any investment decisions.

The Terra Classic story is far from over. Whether it embarks on a steady climb or faces further volatility remains to be seen. One thing is certain: the coming years will be an exciting time to watch LUNC’s development.

Follow us on Twitter, Facebook, Telegram, and Google News

Dr. Olajide Samuel juggles the demands of medical studies with a passion for cryptocurrency. A seasoned blogger, Olajide shares his vast global knowledge of the crypto space, offering insights to enthusiasts. Despite his busy schedule, his commitment to crypto remains strong, and he actively seeks ways to contribute to its future.