Shiba Inu on the Rebound? Whale Accumulation and Exchange Outflows Hint at Recovery

The recent market downturn, particularly the decline in Bitcoin (BTC), sent shivers down the spines of investors across the cryptocurrency landscape. Shiba Inu (SHIB) was no exception, experiencing a significant drop of 71% from its yearly peak of $0.000045 to a low of $0.00001266 on July 5.

Shiba Inu Shows Signs of Resilience

However, a glimmer of hope emerged amidst the market turmoil. As Bitcoin found its footing, SHIB displayed impressive resilience. On July 6, the token defied the broader market trend and registered a remarkable 16% intraday surge. While a subsequent 10% drop followed, SHIB managed to stay above its previous low, currently sitting at a price point reflecting a 29% gain from that level.

Read Also: Horizon Futures Expands Trading Options: XRP, ADA, and LINK Now Available

Whales Accumulate, Exchange Reserves Dwindle

While the recovery momentum seems to have stalled for now, with SHIB consolidating for several days, some interesting developments suggest potential for future growth:

- Whale Activity: A report by The Crypto Basic revealed that during the downtrend, whales accumulated a staggering 6.57 trillion SHIB over one month. This significant purchase spree coincided with a mild decoupling of SHIB from the broader altcoin market, as indicated by Santiment data.

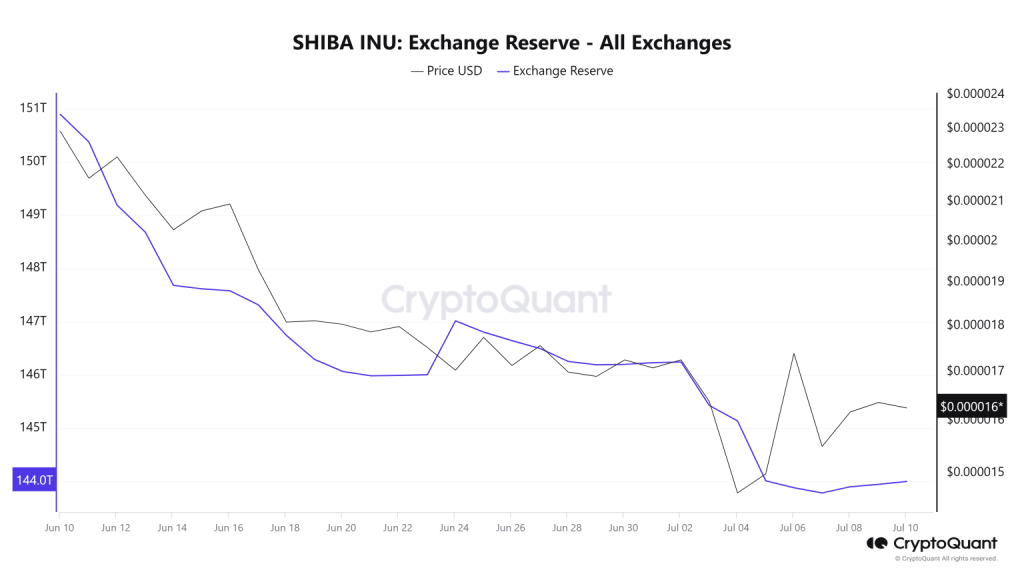

- Exchange Outflows: CryptoQuant data highlights another positive trend – investors have been steadily moving their SHIB holdings off exchanges. In the past month, a total of 6.8 trillion SHIB has been withdrawn, bringing the Shiba Inu exchange reserve to its lowest point in history, currently at 144 trillion tokens.

Shiba Inu’s Recovery Roadmap

Capitalizing on this potentially bullish trend, SHIB could be poised for a significant rebound when the overall market strengthens. However, crucial hurdles need to be overcome:

- Breaking the 20-Day SMA: For a decisive shift in momentum from bearish to bullish, SHIB needs to definitively close above $0.00001681, the 20-day Simple Moving Average (SMA).

- Upper Bollinger Band: Following a break above the 20-day SMA, SHIB must conquer the resistance at the upper Bollinger Band ($0.00001862) to solidify the bullish momentum.

Read Also: XRP: Can it Reach $100? Analyst’s Prediction Reignites Debate

Recovery Targets

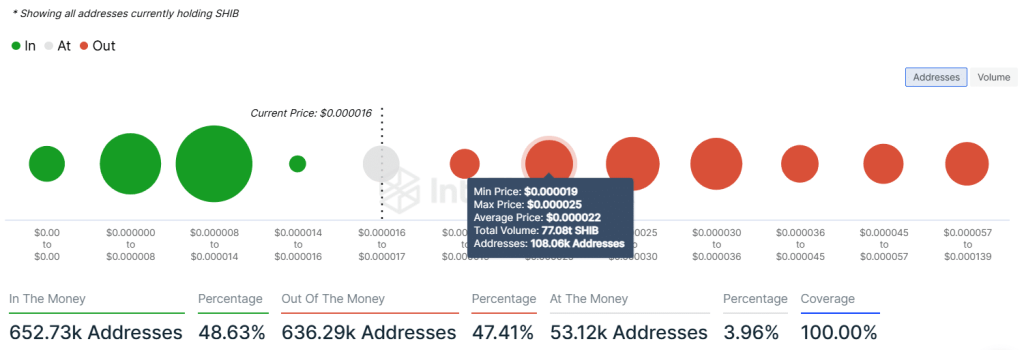

Assuming these initial hurdles are cleared, SHIB has its sights set on three potential recovery targets:

- First Target: $0.00002527: This aligns with the 38.2% Fibonacci retracement level.

- Second Target: $0.00003301: This sits at the 61.8% Fibonacci retracement point. Data shows that 139,110 wallets hold roughly 17.83 trillion SHIB at an average price of $0.000033, making this a significant resistance zone.

- Third Target: $0.000045: This represents the yearly peak for SHIB. Overcoming this hurdle would set the stage for potential new yearly highs. Interestingly, the resistance at this level appears weaker, with a supply wall of only 9.69 trillion SHIB.

Conclusion: A Wait-and-See Approach

While whale accumulation and exchange outflows paint a potentially optimistic picture for SHIB, the cryptocurrency market remains inherently volatile. Investors should closely monitor SHIB’s performance against the identified technical levels and broader market trends before making any investment decisions. The success of SHIB’s recovery hinges on its ability to overcome these hurdles and capitalize on any positive momentum shifts within the market.

Follow us on Twitter, Facebook, Telegram, and Google News

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.