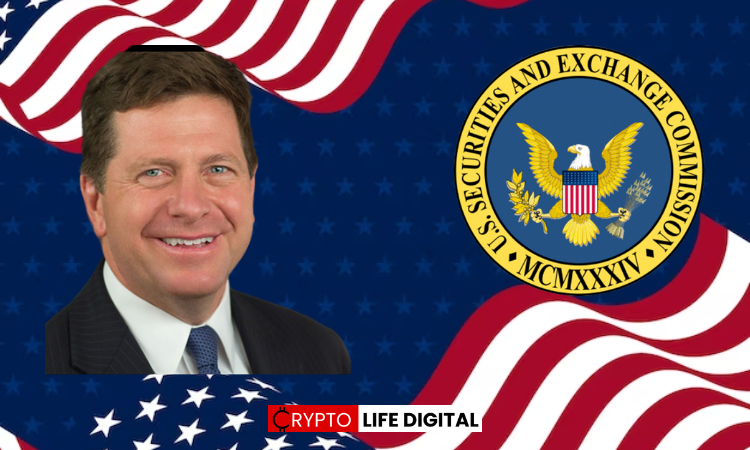

Former SEC Chairman Praises Institutional Interest in Bitcoin as “Remarkable”

In a recent tweet by Bitcoin Magazine, a former chairman of the U.S. Securities and Exchange Commission (SEC) he expressed his admiration for the growing institutional interest in Bitcoin. The former SEC chairman described it as “remarkable” that major financial institutions, including BlackRock, are willing to associate their reputations with the leading cryptocurrency. His comments reflect a shifting sentiment within the regulatory and financial sectors towards the recognition and acceptance of Bitcoin as a legitimate asset class.

Read Also: Grayscale Expresses Concerns Over SEC’s Differential Treatment of Bitcoin ETFs

NEW – Former SEC Chairman: It's "remarkable" that big institutions like BlackRock want to put their reputations behind #Bitcoin pic.twitter.com/hiVG8Z3DFR

— Bitcoin Magazine (@BitcoinMagazine) July 10, 2023

Former SEC Chairman (Jay Clayton) Praises Institutional Investors as Bitcoin take a significant move

The former SEC chairman’s remarks come at a time when Bitcoin has gained significant traction among institutional investors. Traditionally, cryptocurrencies were viewed with scepticism and caution by established financial institutions due to their perceived volatility and regulatory uncertainties. However, recent developments have seen a notable shift in attitudes, with major players like BlackRock demonstrating a willingness to embrace Bitcoin.

BlackRock, the world’s largest asset manager, has been among the institutions at the forefront of this paradigm shift. The company has expressed interest in exploring opportunities related to cryptocurrencies and blockchain technology. By considering investments in Bitcoin, BlackRock is signalling its confidence in the long-term potential of the digital asset and recognizing its relevance in a rapidly evolving financial landscape.

The former SEC chairman’s positive sentiment towards institutional involvement in Bitcoin reflects a broader recognition of the cryptocurrency’s maturation. Bitcoin has come a long way since its inception and is now seen by many as a viable store of value and a potential hedge against inflation. Institutional participation brings increased legitimacy, stability, and liquidity to the market, which can benefit both investors and the overall ecosystem.

Read Also: XRP and Shiba Inu Dominate Trading Volumes on WazirX Amidst Crypto Market Slump

Moreover, the former SEC chairman’s comments highlight the evolving regulatory landscape surrounding Bitcoin and other cryptocurrencies. As institutional interest in digital assets grows, regulatory bodies have been prompted to provide clearer guidelines and establish frameworks to protect investors while fostering innovation. The SEC, in particular, has been navigating the complexities of regulating cryptocurrencies, and the positive reception from former officials indicates a more nuanced understanding and acceptance of the potential benefits of Bitcoin.

Jay Clayton Underscores Institutional Adoption

The former SEC chairman’s observation also underscores the broader trend of institutional adoption in the cryptocurrency space. Beyond BlackRock, numerous other financial giants, including major banks and asset management firms, have shown a growing interest in Bitcoin and blockchain technology. This institutional involvement brings enhanced credibility and stability to the market, facilitating greater mainstream acceptance.

While challenges and regulatory hurdles remain, the fact that influential institutions like BlackRock are embracing Bitcoin suggests that cryptocurrency is entering a new phase of widespread acceptance and integration into traditional finance. The former SEC chairman’s acknowledgement of this shift serves as a validation of Bitcoin’s journey from an experimental digital asset to a recognized investment option.

As institutional interest in Bitcoin continues to grow, it is expected that more regulatory clarity will emerge, providing a supportive environment for further adoption and investment. The former SEC chairman’s statement adds to the chorus of voices recognizing the significance of institutional involvement in Bitcoin and reinforces the notion that cryptocurrencies are here to stay as a legitimate and valuable asset class.

Follow us on Twitter, Facebook, Telegram, and Google News.

Michael Onche: Crypto aficionado and seasoned analyst. With a keen eye for market trends and a passion for blockchain technology, he deciphers the intricacies of cryptocurrency with precision. Michael’s expertise and insightful content make him a trusted guide for navigating the dynamic world of digital assets.