Digital Currency: Can XRP Trigger To $25 By 2025? 2 Reason To Watch Out For.

Digital currencies are conveying messages this February following the market dejection in January. Despite the fact that Q4 of 2023 turned out to be remarkably bullish, the pattern changed with little respect for the approval of spot Bitcoin ETFs in the US.

Altcoins that had been showing extraordinary potential in December, including XRP price gains some to levels the one last found in October and November.

Read Also: Could This Three Support Level Work For XRP In February: A Tale To Watch

Can Bitcoin Price Thrive In The Midst Of Bitcoin Halving

With the ETF far removed, investors in the crypto world are anticipating the next market sector mover attempt, which for this situation is the Bitcoin Dividing. Albeit this occasion straightforwardly affects BTC, it will in general trigger a wide bull market.

Bitcoin’s halving occasion, happening every four years, lessens the block price by 50%, which significantly influences supply dynamics. This modified scarcity, in theory, drives up prices because of classic supply and demand principles.

Nonetheless, the effect on price isn’t quick or direct all of the time. looking at historical perspectives, price floods have emerged a long time after the halving, possibly because of expectations and market cycles.

The past halving happened in May 2020 when Bitcoin [rice traded at around $8,778. Resulting price increments pushed BTC to a pinnacle of almost $69,000 around a year and a half after the occasion.

Furthermore, the Halving impact extends past Bitcoin, frequently triggering bullish feelings across the general crypto market as investors look for alternative high-growth assets.

Nevertheless, ascribing price developments exclusively to Halving is difficult because of the mind-boggling interplay of market influences, regulatory changes, and more extensive economic variables.

While the halving presents a convincing long-haul bullish case for Bitcoin and the crypto market generally, new traders and experienced ought to painstakingly think about these subtleties and lead careful technical and fundamental analysis before settling on investment.

Read Also: XRP As Means Of Cross-Border Payment Services In The U.S.A

XRP Base Out

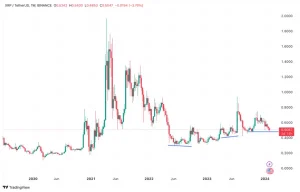

XRP price has returned to levels observed in November and October. This implies that it is trying similar support before the Q4 rally from $0.485 to $0.75. However bears regard this buyer congestion zone, the next move could help XRP focusing on key achievements at $0.6, $0.8, and $1.

The Relative Strength Index (RSI) albeit unbiased at the hour of composing, is approaching the oversold region, inferring that a pattern inversion isn’t distant.

All things considered, traders ought to be watching out for fruitful skips off the significant support range somewhere in the range of $0.54 and $0.48. Essentially, dollar cost averaging (DCA) inside this range would give investors an opportunity not to miss the next move.

Read Also: XRP, $1.4 Billion Is Possible With $100 Investment In February, Here Is How.

Above $1, the increase in the price of XRP could be parabolic and basically driven by FOMO. some holders missed the past bull run as exchanges and other key elements delisted the token on charges of being a security.

Nonetheless, with XRP absolved by the court in July, there’s most unlikely going to be some other time bond to derail the token from hitting another all-time high.

According to Drozdz the market analysis at Conotoxia: “A large-scale upswing in the crypto world could be a boon for XRP. If other cryptocurrencies rise, XRP could well ride the wave”.

A further downfall underneath the range support can’t be ruled out as XRP price is still working through some challenges. Plus, holding underneath the three bull market indicators; the 20-day Exponential Moving Average (EMA), the 50-day EMA, and the 200-day EMA recommend that the chances may as yet favor the bears and lead to a bigger breakdown to the primary support range somewhere in the range of $0.38 and $0.4.

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.