Cardano’s Optimistic Start to the Week Sparks Investor Excitement

Cardano (ADA) experienced a promising start to the week with a rise in value, offering a refreshing change from the significant drops observed in recent weeks. However, while daily analyses showed that the past week ended strongly, a closer look at the volume chart indicated a lack of convergence between investor activities and price movement. This inconsistency raises doubts about the sustainability of the recent trend.

Read Also: Bitcoin Successfully Halves, But Price Impact Remains Unclear

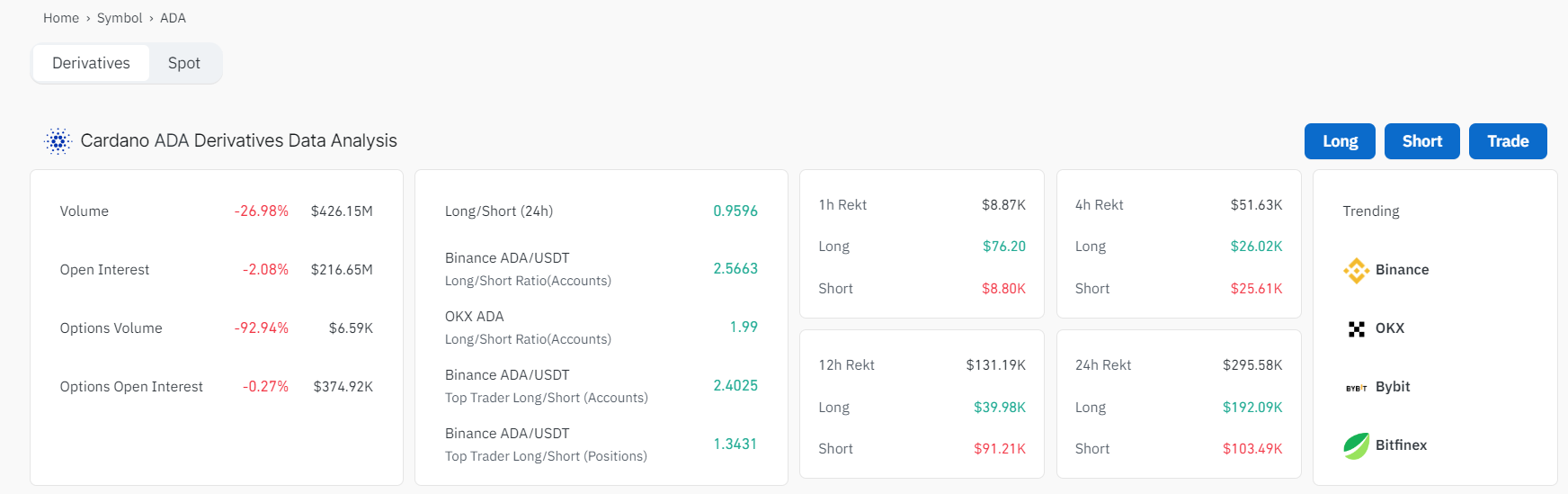

Despite a positive price trend, there has not been a corresponding increase in volume, failing to surpass the $500 million threshold. At the beginning of the week, the volume had risen above $1.3 billion, but it has since nearly halved to hover around approximately $402 million. This stagnant volume indicates a lack of participation by investors, which is critical for sustaining price increases.

Cardano(ADA) Cash Flow

An examination of the Relative Strength Index reveals that it remains below the neutral line, indicating a current lack of positive momentum in the price trend. ADA appears to continue to be entrenched in a bearish trend, with a significant drop in open interest from the levels above $400 million recorded on April 10th. Currently, the open interest is around $216.6 million, indicating a decrease in ADA’s cash flow.

Read Also: Don’t Miss Out: Cardano (ADA) Price Expected to Soar 75% as Technical Chart Predicts

While there has been a slight increase in market attention for ADA recently, it has not yet succeeded in returning to previous levels. Therefore, despite the consecutive rising trends, there are concerns about the sustainability of the current price increase trend, given the lack of convergence between the price increase and volume. With an increasing volume, the current price trend could maintain and potentially strengthen its momentum.

Follow us on Twitter, Facebook, Telegram

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.