Is Dogecoin’s Recent Performance Indicative of a $0.20 Rebound?

Dogecoin is currently at a critical juncture as it experiences a 47% correction in its price, with market analysts divided on its future direction. Historically, DOGE has shown significant price volatility followed by substantial rallies. Previous patterns, such as the descending triangle, have led to significant price increases with the coin surging by 982% after a 40% retraction in 2017. Similarly, a 56% price drop in 2021 preceded a 12,197% bull run. Dogecoin has now emerged from another descending triangle, and some analysts anticipate another major bull run.

Read Also: Dogecoin’s Battle with Resistance Levels: Insights and Analysis

Bull-Bear Argument Amid Ongoing Challenges

However, crypto chartist Rekt Capital recently highlighted a Head & Shoulders pattern on the weekly chart, suggesting potential further declines. Market data confirms this formation, pointing to critical tests at key support zones, including the Macro Downtrend and the black Range Low. These observations suggest that Dogecoin’s current market position is precarious, with essential support levels being tested.

Over the years, #Dogecoin appears to mirror its previous bull cycles! All you need is a little bit of patience. ⌚️ pic.twitter.com/QMqvmJaLkl

— Ali (@ali_charts) May 1, 2024

Recent developments in Dogecoin’s market dynamics indicate significant challenges ahead. In April 2021, the crypto experienced a severe downturn along with the broader market, with its market capitalization plummeting by $3.7 billion over just ten days. Despite a brief rally around DOGE Day on April 20, indicative of a potential recovery, the resurgence was short-lived. The broader impact of the Bitcoin halving event during the same period exacerbated the volatility, as it significantly influenced other major Proof-of-Work cryptos, including Dogecoin.

Overview of On-Chain Data and Miner Activity

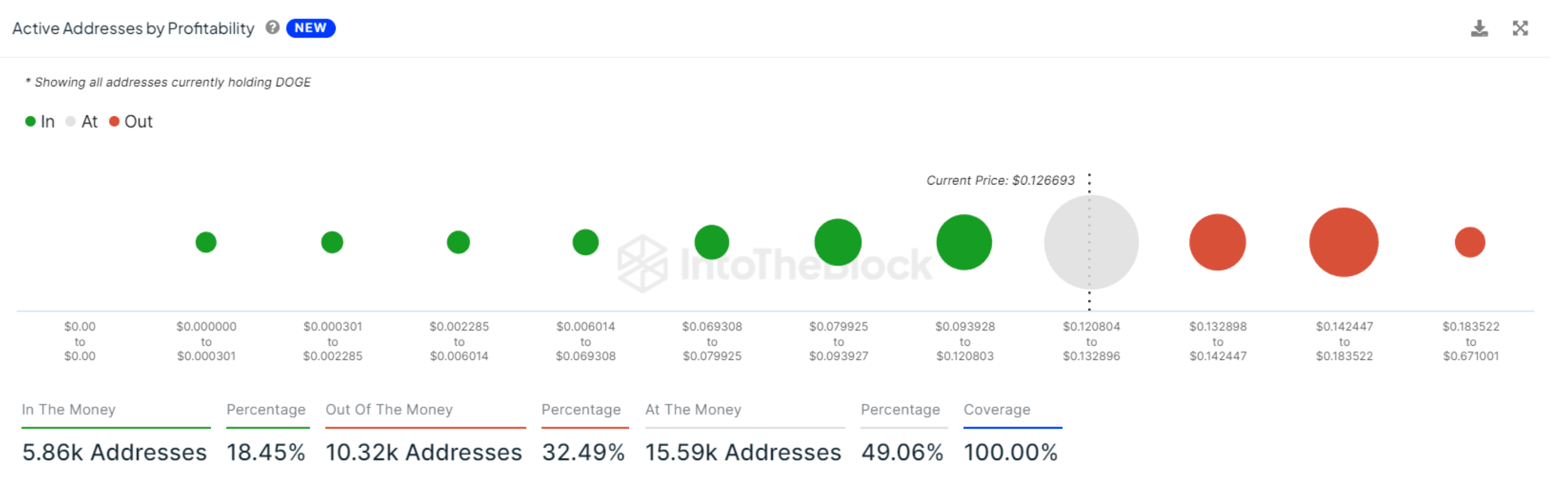

On-chain data reveals an increase in Dogecoin miner activity that could influence the coin’s price direction. Recent shifts in miner reserves suggest a possible continuation of the downward trend. Current on-chain data shows that only 18.45% of Dogecoin addresses are seeing profit on their holdings, compared to 32.49% that are “Out of the Money” (holding at a loss). The largest segment, constituting 49.06% of holders, purchased their Dogecoin at prices around the current market value, indicating potential vulnerability to market shifts.

Read Also: Shiba Inu Whale Accumulates Billions as Crypto Platforms Stock Up on SHIB

As of the latest data, Dogecoin’s value stands at $0.1262, reflecting a 2.99% decline in the last 24 hours and a 16.54% drop over the past week. This downturn has positioned Dogecoin below the performance of the broader cryptocurrency market, which has seen a lesser decline of 9.60% in the same period. The total market capitalization of Dogecoin has also suffered, shedding approximately $3.7 billion over the last ten days.

Follow us on Twitter, Facebook, Telegram, and Google News.

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.