Get Ready For A Major Rally As Chainlink(LINK) Price Surges 7.5%: Big things Ahead

Chainlink (LINK) has demonstrated remarkable resilience during the recent market correction, with its price increasing by more than 6% in the past 24 hours, surpassing $17.50 for the first time in six weeks.

As a provider of Oracle services, Chainlink has notably diverged from the general market correction, experiencing a price surge of over 6% in the last 24 hours. The current trading price of Chainlink (LINK) is in proximity to its crucial resistance level of $17.5, and its market capitalization has exceeded $10.1 billion at the time of this report.

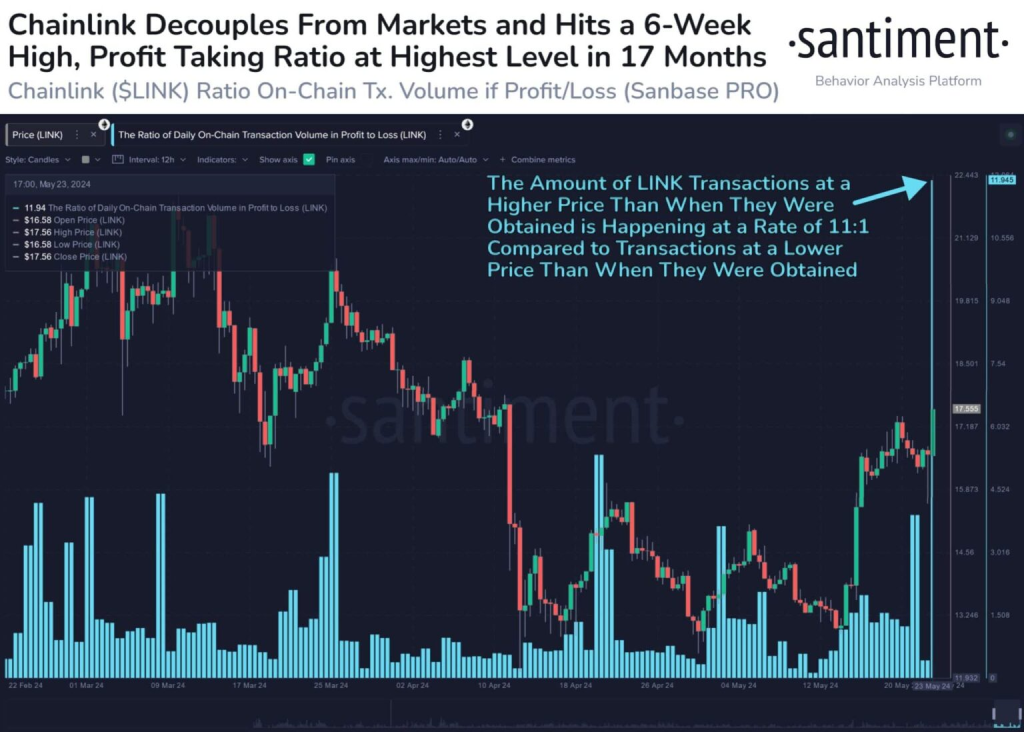

Furthermore, the daily trading volume for LINK has spiked by 80%, reaching a total of $858 million, indicating a significant increase. According to insights from Santiment, an on-chain data provider, LINK has emerged as a standout performer in the cryptocurrency market.

Read Also: US SEC in Talks with Authorities Regarding Terra (LUNA) Founder

Chainlink On-Chain Data Indicate Bullish Trend

On-chain analysis today has revealed a significant pattern: for every single LINK transaction recorded as a loss, eleven transactions have shown a profit, surpassing the ratio seen since December 8, 2022, indicating a significant bullish sentiment surrounding Chainlink’s current price fluctuations after surpassing the $17.50 barrier for the first time in six weeks.

Due to a daily bearish order block, characterized by substantial market participants placing sell orders at $17.58 in the past, the current price of Chainlink is encountering resistance. In this case, the weekly resistance barrier is located at $16.48, aligning with this resistance level.

If buyers are unable to drive the price of LINK higher, there is a possibility of a retracement. Analysis of the volume profile suggests that a significant volume of trades occurred around $14.62, indicating potential support for the predicted correction, should it occur.

It is important to note that this level aligns closely with the 61.8% Fibonacci retracement level, presenting an attractive accumulation zone for a potential second bullish run. The introduction of an Ethereum spot exchange-traded fund (ETF) has fueled recent bullish sentiment, contributing to increased optimism.

If Chainlink signals an 18% rally to retest the $17.58 daily order block and finds support around $14.62 before the end of the day, a successful breach of this resistance level could propel the price of Chainlink to $22, marking a total gain of fifty percent amidst the accumulation of Chainlink whales.

While rigorous technical analysis and on-chain data support Chainlink’s potential, a weekly candlestick closure below $13.59 would nullify the bullish outlook by forming a lower low on a higher timeframe. Such an event could lead to a 13% decrease in the price of LINK, bringing it closer to a critical support level of around $11.80.

Read Also: Solana Meme Coins: Unleashing 100X Gains Potential This Week

Additionally, on-chain data indicates that Chainlink has made significant strides. On May 18, there were 2,900 active addresses within the Chainlink network. By May 21, that number had increased to 11,300, reflecting a substantial growth in the number of active addresses within the network. This significant growth underscores the high demand for the Chainlink platform.

Follow us on Twitter, Facebook, Telegram, and Google News

Tolu Zach is a multifaceted professional with expertise in both crypto content creation and medical laboratory technology. With a unique blend of analytical skills and industry knowledge, Tolu navigates the complexities of cryptocurrency while maintaining a pivotal role in healthcare. Trusted for insightful analysis and accurate diagnostics, Tolu excels in diverse fields.