Bitcoin Hackers Carted Away $30 Million Worth of BTC

The recent movement of stolen Bitcoin (BTC) has sparked concerns in the crypto market. The hacker responsible for the DMM Bitcoin breach transferred a substantial amount of BTC, approximately $30 million, leading to speculation about a potential market dump. This comes in the wake of significant sell-offs by government entities and miners.

The Overview

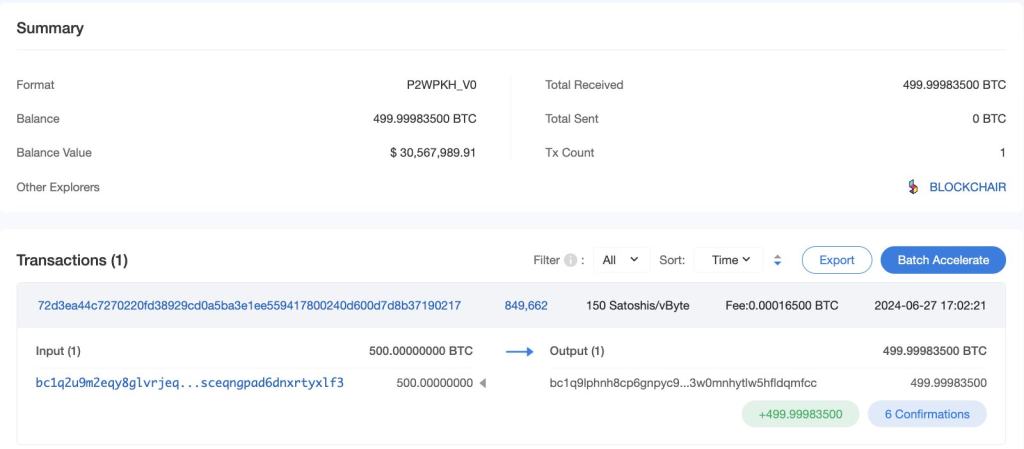

Following the security breach at DMM Bitcoin earlier this month, where 4,502.9 BTC valued at over $300 million was stolen, the hacker has now transferred a portion of the stolen funds to a new address. Despite fears of a market dump, on-chain transactions do not currently indicate a large-scale sell-off of the stolen BTC reserve.

However, there is apprehension that the hacker may look to liquidate their holdings for profit. This could occur during a significant rebound in Bitcoin’s price as the hacker seeks to capitalize on higher profits through price appreciation.

Read Also: Terra Luna Classic Price Set to Soar Amid Massive Binance Burn

DMM Bitcoin Response

In response to the breach, DMM Bitcoin has taken measures to address security vulnerabilities and reassure its customers. The exchange suspended new account openings, crypto asset withdrawals, and the acceptance of new buying orders for spot trading. Withdrawals in Japanese yen may also experience delays.

The financial regulator in Japan, the Financial Services Agency (FSA), has instructed DMM Bitcoin to thoroughly investigate the breach and implement measures to protect customers from potential damages. DMM Bitcoin has assured its customers that their compromised BTC holdings will be covered with the support of the exchange’s group companies.

Market Trends and Performance

Amidst these developments, there have been significant sell-offs in the broader Bitcoin market. The German government recently liquidated its Bitcoin holdings and transferred a substantial amount to major crypto exchanges. Similarly, the U.S. government moved a considerable quantity of BTC to Coinbase Prime. This governmental sell-off, coupled with Bitcoin miners and whales offloading their holdings, has led to market volatility and a price just above the critical $60,000 support level.

The market is currently exhibiting indecisiveness, with Bitcoin trading below the 50-day simple moving average (SMA) but above the 200-day SMA. Short liquidations have exceeded longs, with $18.01 million in short liquidations, indicating potential further rebound as traders buy back their BTC positions to limit losses. Nonetheless, longs also faced considerable liquidations of over $10 million in the last 24 hours.

Read Also: ShibArmy Howls: 30th Edition Packed with Space, Giveaways, and Shibarium News

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.