Bitcoin’s Price Slumps Below $55,000 Amidst Market Turbulence

The dominant cryptocurrency, Bitcoin experienced a drop below $54,000, marking one of its steepest declines since February. This significant downturn led to substantial liquidations totaling nearly $700 million. Analysts attribute several factors to this decline, including the large-scale liquidation of Bitcoin by the German government and the anticipated release of over 140,000 BTC, valued at approximately $7.7 billion, to creditors of the now-defunct Mt. Gox exchange.

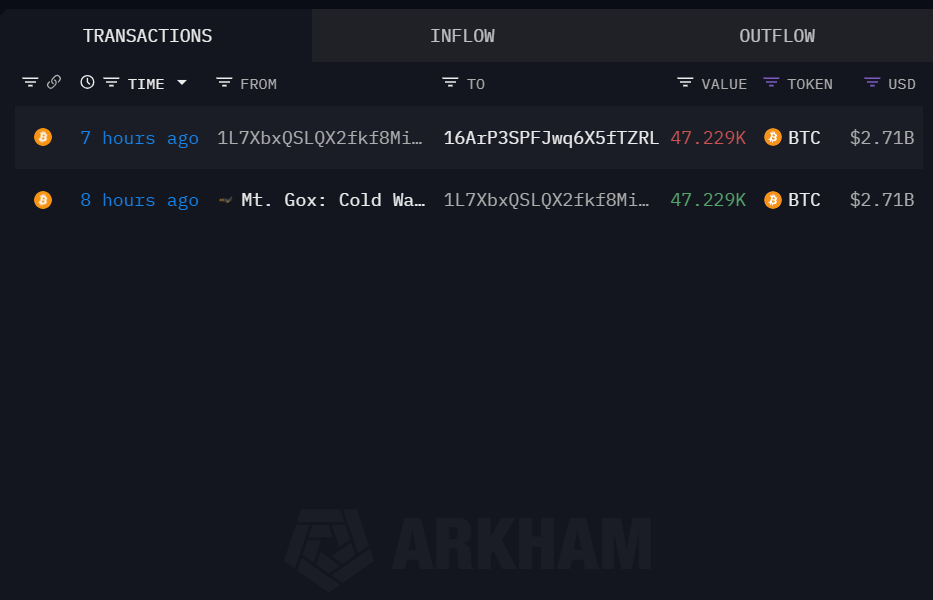

Mt Gox’s Transaction

The German government’s decision to sell its Bitcoin holdings exerted downward pressure on BTC prices. Furthermore, the impending release of Mt. Gox’s BTC could flood the market, exacerbating the downward trajectory. The transfer of over $2.7 billion worth of Bitcoin from the exchange to a new address has raised concerns about a massive sell-off.

Read Also: Understanding the Technical Aspects of XRP’s Lagging Performance Compared to Bitcoin and Ethereum

In addition to Bitcoin, alternative cryptocurrencies such as Ripple (XRP), Binance Coin (BNB), and Cardano (ADA) have experienced significant declines, surpassing the losses registered by Bitcoin. Ripple, in particular, reached a one-year low below $0.40. Even meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have suffered losses, with some tokens losing nearly 20% of their value.

Market Trends

Despite the overall negative trend, select cryptocurrencies within the top 100 have shown resilience. Notable exceptions include Fasttoken (FTN), which saw a modest 3% increase, and Leo Token (LEO), which experienced a marginal 1% rise. These exceptions underscore the volatile and unpredictable nature of the crypto market.

Read Also: Dogecoin Whale Massive Purchase, Despite Market Turmoil

In conclusion, the cryptocurrency market is currently characterized by significant volatility, with major assets experiencing substantial declines. While Bitcoin’s drop below the $55,000 mark has been a central driver of liquidation events, other cryptocurrencies have also faced significant devaluations. Given the unpredictable nature of the market, it is essential for investors to remain well-informed and exercise caution when navigating these turbulent waters.

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.