Dogecoin’s Price Dips Spark Fear of Selling Pressure – What Investors Need to Know

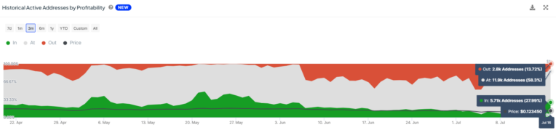

Dogecoin’s recent price movement has breached an important rising wedge pattern, hinting at a potential bearish sentiment among investors. The substantial drop in June has raised uncertainties about DOGE, prompting some long-term investors to consider capitalizing on gains by offloading their holdings. Moreover, currently, only 27% of active DOGE addresses are showing profits, indicating a challenging market environment.

Market Trends and Performance

The Market Value to Realized Value (MVRV) ratio, presently at 8.6% over 30 days, is a critical metric to monitor. Historically, MVRV levels between 6% and 20% have often foreshadowed corrections in DOGE prices. The current ratio indicates a potential surge in selling pressure, which could impact short-term price movements. Ongoing vigilance of the MVRV ratio is imperative for assessing market sentiment and anticipating potential price fluctuations.

Read Also: LUNC Rallies 33%: A Bullish Signal for Terra Classic?

With Dogecoin trading at approximately $0.122, the focus is on attaining $0.128, which could translate to a 5% price upturn. However, reaching this target may be uncertain given the existing market conditions. Should DOGE hit $0.128 but fail to maintain its position, the price could retreat to $0.116, possibly cascading further to $0.105. These developments could reverse the recent 17% weekly gains, introducing intricacy into the investment landscape.

What Investors Need to Know

Key considerations for investors encompass the current 30-day MVRV ratio, which signals potential selling pressure, and the fact that only 27% of active DOGE addresses are currently profitable, indicating a challenging market scenario. Furthermore, historical MVRV levels between 6% and 20% often presage imminent price corrections. It’s also prudent to monitor critical support levels at $0.116 and $0.105. A breakthrough above the crucial resistance at $0.142 could signify the conclusion of the ongoing downtrend and the potential for future gains.

Conclusion

In summary, the prevailing trends in Dogecoin’s price movements warrant a cautious approach. Continual monitoring of key metrics, such as the MVRV ratio and critical support/resistance levels, can furnish valuable insights for navigating market volatility and informing judicious investment decisions.

Read Also: XRP’s Dominance Strengthens, Setting the Stage for a Potential Massive Breakout

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.