Cardano (ADA) Aims For an 87% Surge, Defying Holder Outflow

Cardano (ADA) price has been on a downward trend despite significant updates from the team. The upcoming Chang hard fork was anticipated to drive the ADA price upwards, but market conditions have seemingly hindered this outcome.

During the European trading session, ADA price experienced a 5% drop, trading at $0.396, with on-chain analysis indicating holder outflow in preparation for the Chang hard fork. However, the ADA price chart suggests a potential bullish trend, with a projected path to $0.68 in the near future.

Cardano Founder Optimism on Cardano’s Future

Cardano founder Charles Hoskinson has expressed his belief that Cardano could potentially replace Bitcoin in the future. According to Hoskinson, Bitcoin’s utility is limited, leading him to conclude that it could be replaced. However, despite this viewpoint, the recent 5% loss in ADA’s value may be linked to Bitcoin dominance, causing the ADA/BTC price to drop by 2%.

Read Also: Terra Classic Requests Clarification From TFL CEO and eToro Regarding LUNC Delisting

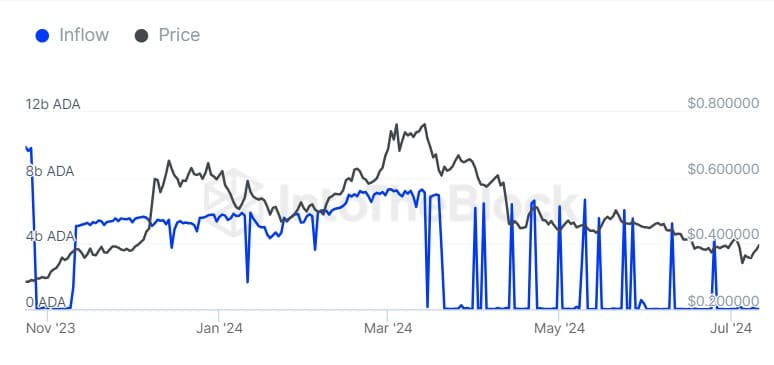

Data from IntoTheBlock indicates that Cardano whales are currently inactive, with a 99.79% decrease in inflow activity and an increase in outflows. This decline in whale activity might signal decreased investor confidence or portfolio rebalancing.

Analyzing the Cardano price forecast, despite the current downtrend, there are indications of a potential reversal as the asset approaches key support levels and forms a bullish pattern. Additionally, the multi-month falling wedge pattern in the Cardano price chart suggests a possible reversal, with a potential impulsive upward move following a rebound from the upper trendline of the wedge.

The ADA price is currently below the 50-day ($0.4181) and 200-day exponential moving average (EMA), indicating a bearish trend. However, there are attempts to break above the 50-day EMA. Key resistance levels to monitor are $0.46, $0.54, and $0.60. The forecast suggests a potential correction to $0.36 before a projected 87% rebound to $0.68. Critical support areas include $0.33 and $0.28.

Technical Analysis

Technical indicators show that the relative strength index (RSI) is at 44.60, indicating a slight bullish divergence. The RSI crossing below its 14-day SMA suggests potential short-term bearish momentum before a price reversal. The Chaikin Money Flow (CMF) at 0.13 has been consolidating since July 13, indicating minimal capital inflow and buying pressure.

In summary, the technical indicators suggest a potential correction followed by a price surge for the ADA crypto asset.

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.