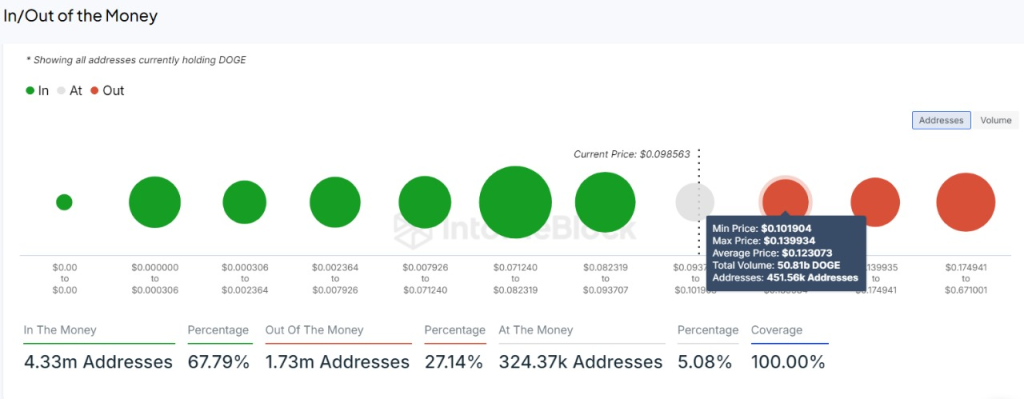

DOGE Price Forecast: Over 451,000 Dogecoin Investors Eagerly Await Potential Profits as DOGE Aims for $0.12

Dogecoin’s price is displaying signs of recovery, with a bullish pattern emerging on its daily chart. The asset has reached the lower end of the bullish market structure and has the potential to rally by 27%. After the recent market downturn, Dogecoin investors were rushing to offload their coins on exchanges. However, as the market started to recover, there was a significant reduction in exchange inflows, setting the stage for a bullish rally for this cryptocurrency.

DOGE Within a Falling Wedge Pattern

The current DOGE price is trending downward within a falling wedge pattern, which typically indicates a bullish reversal. Recent candlestick formations have demonstrated a strong bounce off the lower boundary of the wedge with notable volume, signalling a potential reversal. The movement within the falling wedge pattern suggests a corrective wave. However, the recent bounce from the lower boundary could indicate the end of a corrective wave and the beginning of a new impulsive wave.

Read Also: FOMO Alert: Analyst Predicts 7,193% Increase for Shiba Inu to $0.001

Notably, the 50-day EMA at $0.122 and the 200-day EMA at $0.126 are both above the current price, affirming the bearish trend. The immediate support for Dogecoin price stands at $0.095, near the recent low, while resistance exists at $0.1053 (the recent high) and at the 50-day EMA ($0.122).

With the RSI at 32.50, DOGE is presently in oversold territory, suggesting a potential price bounce. The Chaikin Money Flow (CMF) is at -0.03, indicating mild selling pressure but not excessively strong.

Overview of the On-Chain Metrics

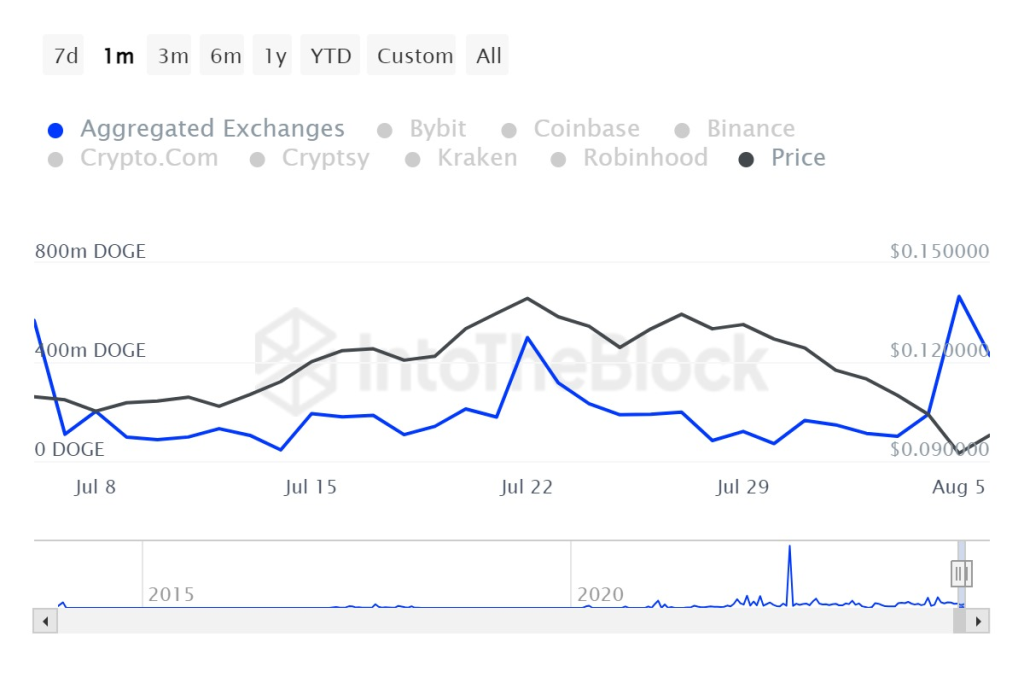

Analysis of Dogecoin’s on-chain metrics reveals that investors have been withdrawing their funds from exchanges. Exchange inflows dropped by 38.85% from $664.48 million to $426.24 million over the last day. This decline follows a peak in exchange inflows, the highest in the last month, which was stimulated by the recent market crash.

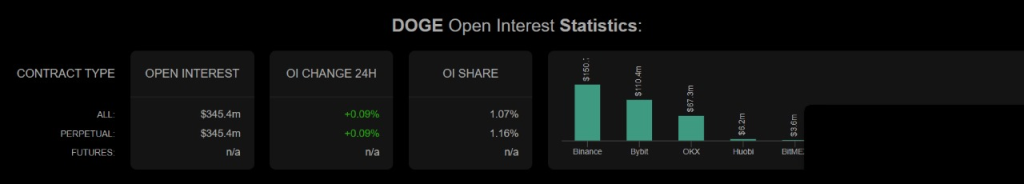

Moreover, Dogecoin’s open interest has seen a slight increase of 0.09%, signalling a recent rise in market activity. When coupled with the rising price, this may indicate the onset of rising buying pressure for the meme coin.

If Dogecoin’s price were to rally and break above the falling wedge pattern, it is expected to increase DOGE’s value in the long term and establish new price targets around $0.14, $0.17, and $0.21. Overall, the falling wedge pattern hints at a potential reversal, especially considering the increased volume and RSI in oversold levels. There are short-term long opportunities, although long-term traders may prefer to wait for confirmation of a trend reversal.

Finally, the recent developments in “Payments” integration on X could act as a catalyst to push the Dogecoin price over the edge and into the breakout zone. If market conditions were to reverse and become overly bearish, Dogecoin exchange inflows may resume, potentially signalling market panic and turning out to be bearish for the asset’s price.

Read Also: Solana’s Strong Resilience Reflects Robust Market Confidence as Crypto Bounces Back

Follow us on Twitter, Facebook, Telegram, and Google News

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.