Discover Why PEPE, MATIC, and ADA Prices May Skyrocket Following the Recent Bitcoin Crash

The recent Bitcoin crash below the $60000 mark has created Fear, Uncertainty, and Doubt (FUD) in the market. While the current consolidation trend does not show a clear sign of a bottom formation, oversold altcoins like Polygon (MATIC), Pepe coin (PEPE), and Cardano (ADA) hold potential for a price reversal.

The Bitcoin crash to $56000 on Thursday has raised concerns about market sustainability and the risk of a potential crash, despite a renewed recovery sentiment earlier this month for most major altcoins.

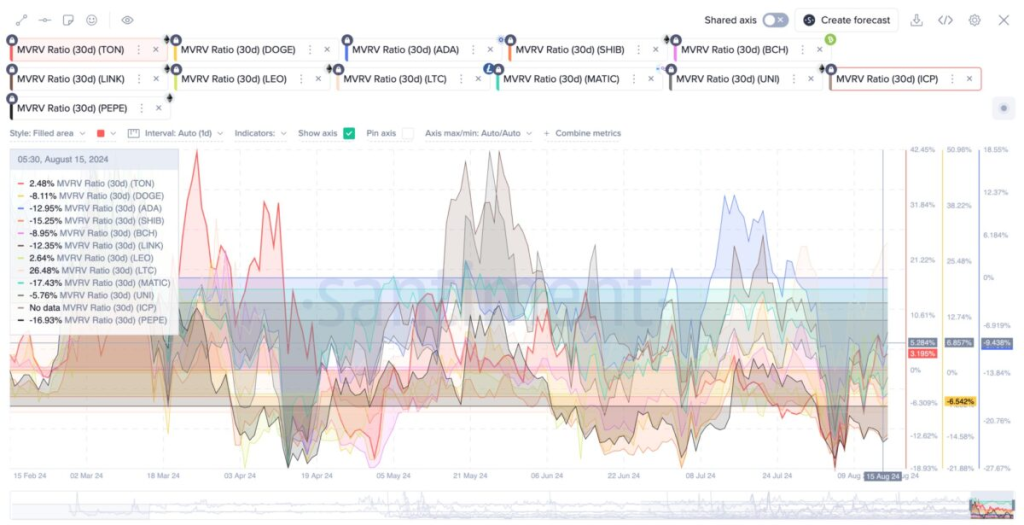

Santiment reports that the 30-day Market Value to Realized Values (MVRV) for Polygon (MATIC), Pepe coin (PEPE), and Cardano (ADA) has plunged to -17.43%, -16.93%, and -12.95%, respectively. These negative values suggest that investors who bought these tokens in the past month are currently at a loss. This could signal an opportunity for accumulation by long-term investors.

Read Also: Shiba Inu Battles to Hold Key Support at $0.000012 as Memecoin Cap Takes a 26% Dive

Looking at the technical analysis, the Polygon price is showing a falling wedge pattern in the daily time frame chart, signalling a potential breakout from the current bearish momentum. Similarly, the PEPE coin is expected to seek support from a wedge pattern before a potential recovery leap, while Cardano’s recent bounce from a major support level reflects uncertainty among traders.

In summary, despite the recent Bitcoin crash and negative market sentiment, there are potential buying opportunities for these altcoins, based on technical analysis and market indicators.

Read Also: Cardano Community Shows Its Support for the SNEK Meme Coin, as ADA Gear Up for Comeback

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.