MATIC Price: Whale Investors Trigger Polygon Price Rebound After Extended Correction

The price of Polygon (MATIC) surged by 6% during Wednesday’s U.S. trading session, propelled by a general market upturn. This bullish momentum was supported by significant whale buying and a surge in network address activity, resulting in a decisive breakout from a five-month correction trend. The key question now is whether this recovery trend will be sustained.

Unveiling Polygon Price Breakout Signal

Analysis of the daily chart for Polygon reveals a consistent downtrend since April 2024, characterized by a falling wedge pattern. Despite encountering major dynamic resistance and support from two downsloping trendlines, the converging nature of these lines typically signifies a weakening bullish momentum.

Read Also: Analyst Bold Prediction: XRP Poised to Reach $44, Outshining Bitcoin with a Massive Price Surge

In defiance of the recent market correction, the price of this altcoin rallied from $0.398 to $0.48 over the past week, translating to a robust 22% growth. This recovery can be attributed to the announcement by Polygon that the MATIC token will migrate to POL on September 4. The market reacted positively to this news, leading to a decisive breakout from the wedge pattern. A daily candle closing above the resistance and a 4.6% surge indicate an early indication of a trend reversal.

With sustained buying, it is possible for the MATIC price to surge by 57% and challenge the $0.57 resistance level. Despite the ongoing correction, a notable surge has been observed in the distribution of MATIC supply among addresses holding between 100,000 and 1,000,000 coins. Data from Santiment shows a recent surge to 830 MATIC, indicating that larger investors are accumulating the asset in preparation for a further rally.

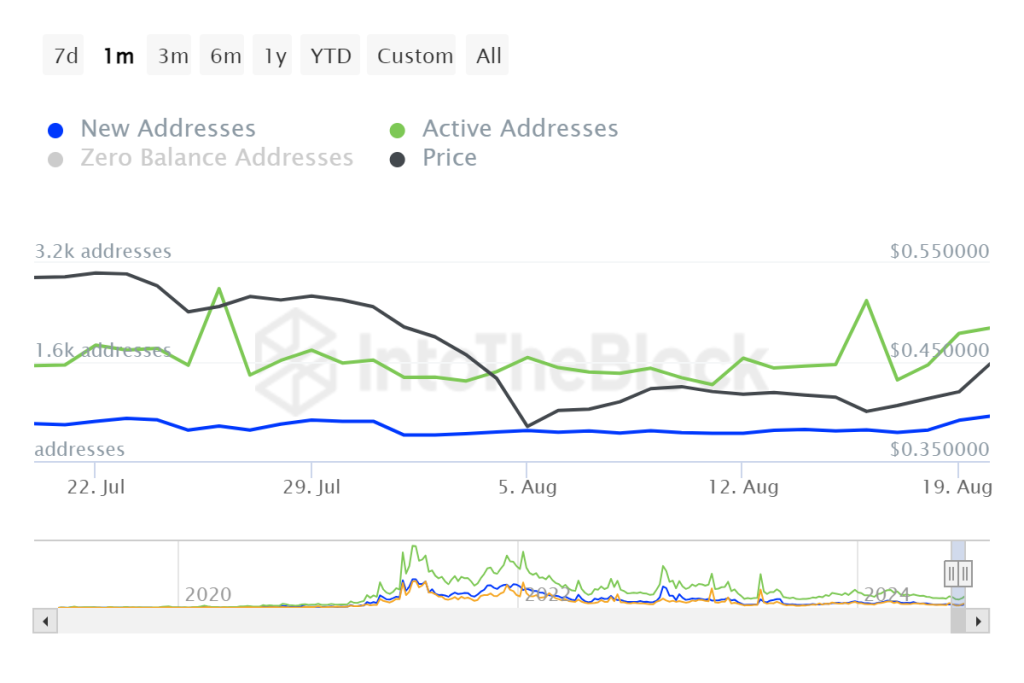

According to Intotheblock analytics, there has been a significant increase in new addresses within the Polygon network, rising from 463 to 725 in just one week. Furthermore, active addresses have increased from 1.31k to 2.15k. This surge in new and active addresses indicates growing interest and participation in the Polygon network.

The uptick in new addresses suggests a rise in user adoption, likely driven by the network’s scalability and recent developments. Meanwhile, the jump in active addresses indicates increased network activity and engagement, signaling heightened network utility.

Final Thought

However, it is important to note that the 50-day Exponential Moving Average (EMA) at $0.48 could provide strong support for sellers to counteract. A potential breakdown below the downsloping trendline would invalidate the bullish thesis and could lead to a drop in the polygon price below $0.4.

Read Also: Terra Community Gearing Up for the TFL and TLL Plan Confirmation Hearing

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Raliat: A rising star in the crypto world, blending expertise with a passion for analysis. With a knack for simplifying complex concepts, she empowers audiences to understand and navigate the blockchain landscape. Raliat’s insightful content and analytical prowess make her a trusted guide in the ever-evolving world of cryptocurrency.