SunPump’s Buyback and Burn Strategy Could Send SUN Price Soaring

It’s evident that SUN price has been consolidating after a significant rally following the launch of the platform and subsequent promotion by Tron Founder Justin Sun. The retracement has been influenced by general market conditions, particularly due to Bitcoin’s erratic movements. However, a game-changing move was made by Sun with the announcement of a 100% on-chain buyback and burn for SunPump, expected to drive the price to new highs.

Burn Impact on SUN Price

Justin Sun opting for the 100% buyback and burn method on September 3, instead of burning the liquidity LP tokens as suggested by the community, signifies a strategic shift. Sun believes this new approach to be straightforward and easier to verify. With a total supply of 19.9 billion tokens and 9.8 billion in circulation, coupled with a $278 million market cap, the potential of this buyback and burn to propel the asset to a $1 billion market cap and beyond is substantial.

Read Also: Solana ETFs Definitely Not in the Works Says CF Benchmark CEO

The high market cap achieved by SUN on August 25 during the short meme season on the Tron network was notable, especially considering that SUN had a total supply of only 21,000,000 at the time, and the SUN price had surpassed $50.

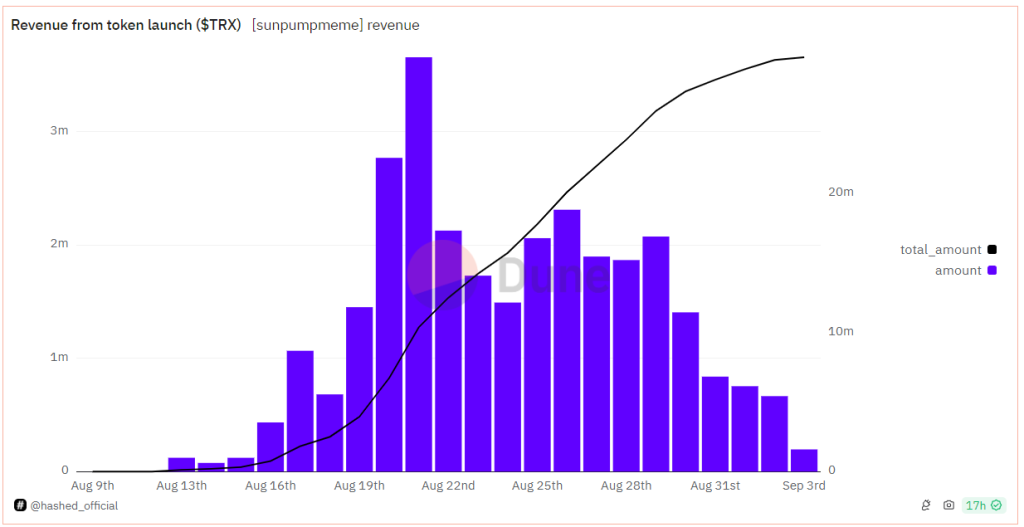

SUN Analysis on DUNE Platform

The buyback and burn process are directly tied to the fees generated by the SunPump platform. According to Dune Analytics, SunPump’s revenue from token launches hit a low since August 16. The platform only generated 195,671 TRX ($29,743) in revenue on September 3, a significant drop from its peak revenue of over $555,000 in a single day. This demonstrates the potential for significant growth as the platform expands.

Technical Analysis

Technical analysis suggests that while the longer-term trend is bullish, SUN is currently in a short-term sideways consolidation pattern, with the price oscillating between the 50% and 61.8% Fibonacci retracement levels.

In the short term, SUN price is likely to face resistance around the 23.6% Fib level at $0.033, with a potential uptrend continuation of up to 90% upon breaking above this level. On the other hand, the 61.8% Fib level at $0.026 offers strong support, and a breach of this level could lead to a further decline toward the 78.6% Fib level at $0.022.

As the market hovers around the 50% retracement level, a critical juncture approaches where the next market move is determined. The confluence of the 61.8% retracement level with the lower boundary of the recent range makes it a crucial support area. The price action of SunPump also signals a possible formation of a double top, emphasizing the importance of maintaining a price above the 61.8% Fib level to sustain recent gains.

Conclusion

In conclusion, significant price volatility is expected in line with developments in SunPump’s fundamentals. Despite the price maintaining a relatively steady pattern since the announcement of the 100% buyback and burn, investors are attentively evaluating the sentiment across the crypto space.

Read Also: Ripple CTO Shares His Thoughts on Why He Prefers Using XRP on XRPL Instead of RLUSD

Follow us on Twitter, Facebook, Telegram, and Google News

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.