Ripple Lab Incinerates 470 RLUSD Stablecoin Tokens, What’s In Store for RLUSD?

In a significant development, Ripple Labs has actively engaged in the development and testing of the Ripple USD (RLUSD) stablecoin, having recently minted a substantial number of RLUSD tokens. The company has also disposed of a significant portion of the minted stablecoins in multiple batches, with four separate transactions involving 115 and 120 RLUSD tokens each.

Ripple Burn 470 RLUSD

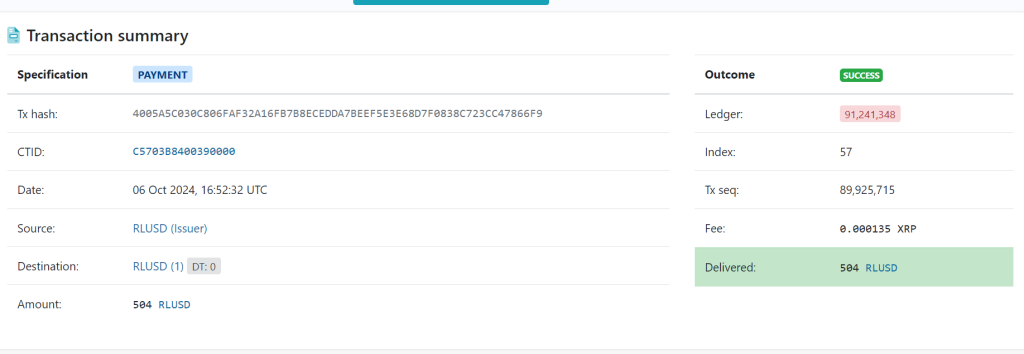

Ripple executed the disposal of 470 RLUSD stablecoins subsequent to the minting of over 1000 RLUSD tokens in the past week. This disposal occurred through four distinct transactions, comprising two disposals of 115 tokens and two of 120 tokens each, conducted at the RLUSD Treasury. These activities form part of an ongoing testing phase for its new stablecoin project in a private beta.

Read Also: The Importance of Tax2Gas, Staking, and USTC Re-peg

Since August 2024, Ripple has been rigorously testing its RLUSD stablecoin, designed to be pegged to the U.S. dollar and backed by cash equivalents. The company has minted several batches of RLUSD, with the most recent issuance totaling 1.35 million RLUSD tokens. Additionally, smaller tranches, including batches of 500 RLUSD, were issued on October 6.

While Ripple has actively developed RLUSD, the company maintains a cautious approach. It has communicated to the XRP community that the stablecoin is still undergoing testing and will not be publicly available until regulatory approvals are secured and the product is fully launched.

Ripple Initial Plans on ETH and XRP Ledger

Initially, Ripple planned to launch RLUSD on both the Ethereum and XRP Ledger (XRPL) blockchains. However, recent updates suggest that the RLUSD stablecoin will first be released on the Ethereum network, prompting discussions within the XRP community. The company has affirmed that the stablecoin will eventually be launched on the XRPL by 2024. However, RLUSD on XRPL may initially lack crucial functionalities such as the Automated Market Maker (AMM), which will be confined to the decentralized exchange (DEX) orderbook on XRPL.

Former employees and industry insiders maintain an optimistic outlook on the stablecoin’s potential to benefit XRP, with one former Ripple employee expressing the belief that RLUSD will enhance liquidity to XRP and bolster its utility, particularly in cross-border payments.

The increasing utility and liquidity of XRP could potentially propel its price upwards, particularly as the company intends to expand the RLUSD stablecoin and integrate it into its broader ecosystem. At the time of writing, XRP is priced at $0.53, reflecting a 0.72% decrease in the past 24 hours, while the 24-hour trading volume has experienced a 24% surge, exceeding $1.1 billion.

Read Also: Terra Classic Votes on Phoenix Directive: A Push for Alliance Reform and Ecosystem Growth

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.