LUNC Price To Hit 480% Surge Amid Rising Burn Rate, Analyst Predicts

Terra Luna Classic (LUNC) has recently faced significant pressure, retreating 10.95% from its weekly peak. Currently, LUNC is trading at a critical psychological support level of $0.00010. However, one prominent analyst forecasts a potential bullish reversal, suggesting that LUNC could surge by approximately 480% in the near term.

Bullish Forecast from Crypto Analysts

Despite LUNC’s underperformance relative to leading cryptocurrencies such as Bitcoin and Solana—both of which have seen over 100% gains this year—the token remains entrenched in a bear market, having declined over 60% from its early-year highs.

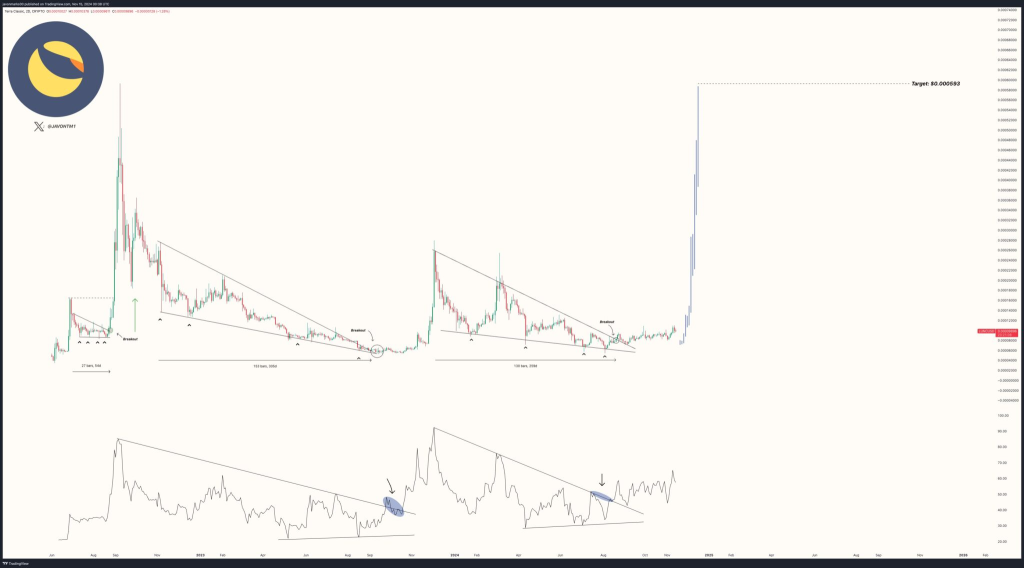

Javon Marks, a well-regarded crypto analyst known for his accurate market predictions, posits that LUNC has the potential for significant upward movement. He anticipates a price target of $0.000593, representing a roughly 480% ascent from its current valuation.

Read Also: Terra Classic Soars: A Bullish Outlook

Marks bases his projection on LUNC’s historical performance and the emergence of falling wedge patterns. The coin has formed three key wedges historically, each preceding substantial bullish breakouts. Should this trend continue, he expects the token to approach $0.000593, just shy of its all-time high of $0.000064. Falling wedges are characterized by two declining and converging trendlines; traditionally, they culminate in bullish breakouts as the lines converge.

Catalysts for Price Growth

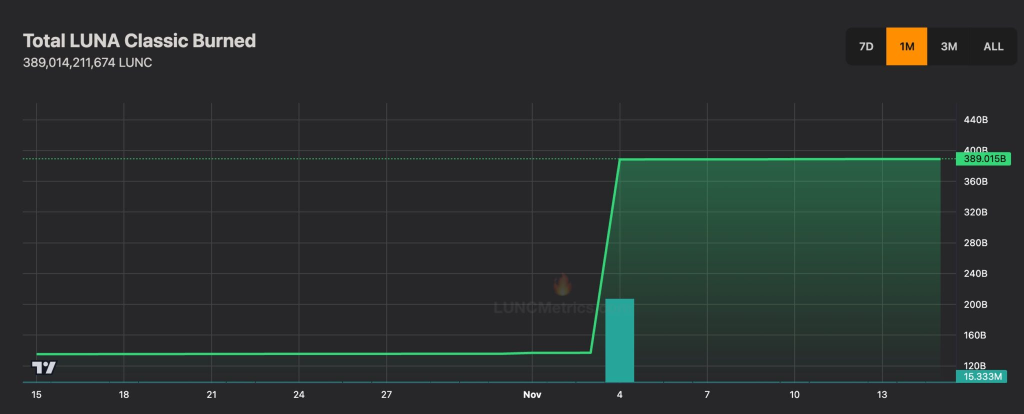

LUNC has two primary catalysts that could propel its price higher. Firstly, there is a noticeable uptick in the Terra Luna Classic burn rate, with over 389 billion LUNC tokens having been burned since inception. A significant spike in the burn rate occurred when Terraform Labs shut down the Shuttle Bridge as part of its bankruptcy proceedings. Secondly, a continued bullish momentum in the broader crypto market could further buttress LUNC’s price.

Technical Indicators

Technical analysis suggests that LUNC is well-positioned for a bullish breakout. The daily chart reveals the formation of an ascending regression channel, reinforced by both the 50-day and 100-day moving averages.

Moreover, the Market Value to Realized Value (MVRV) Z-score has ascended to around 2.7, nearing levels not seen since April. While this could indicate overvaluation, there remains upside potential toward $4.6, the highest level this year.

Further bullish confirmation would arise if LUNC breaks above the upper boundary of the ascending channel at $0.00010. Such a breakout would suggest possible gains toward $0.00013, which represents a 33% increase from current levels. The bullish outlook would be invalidated if LUNC drops below $0.000085, the lower boundary of the channel. Such a decline could trigger a further descent towards $0.000053.

Read Also: XRP’s Price Action: Analysts Anticipate Frustration but Potential ATH Soon

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.