Bitcoin Sets A New All-time High: Factors Behind the Surge

The crypto-positively trending market is now going full speed ahead as Bitcoin slips into its price disclosure phase after triumphing above its previous all-time high. In the midst of this phase, BTC has kept on recording new ATH values, outperforming past assumptions.

In any case, one of Bitcoin’s significant price surges came up today as the asset pushed over the essential obstruction edge at $72,000, setting to a new high level of $72,226 recently. In spite of confronting an obstruction at this price, BTC holds above $71,900.

Read Also: Factor That Suggest Bitcoin’s Next Move

Reason Behind The New ATH

As the crypto asset hopes to leverage another rise to hit above $72,000, information in the market has uncovered some of the reasons and significant variables that are responsible for the recent surge to the $72,000 mark. The on-chain observation platform Lookonchain pointed out one potential component.

Throughout the end of the week, Lookonchain highlighted a transaction from the Tether Treasury, which saw the minting of $2 billion worth of USDT on March 10. As per information made available by Lookonchain, the firm has proactively minted about $5 billion in USDT on the Ethereum and Tron blockchains over the course of last week.

Curiously, in the midst of yesterday’s minting of the 2 billion USDT, a whale address that is conceivably owned by an institution got 261.6 million USDT from Tether. The inflows started on the 9 of March at 12:39 (UTC), with the last transaction recorded to have come in on the 10 of March.

After #TetherTreasury minted 2B $USDT, a whale/institution received 261.6M $USDT from #TetherTreasury and deposited it into #Binance.https://t.co/ohBcxqbrzThttps://t.co/Cxs2WfFPCn pic.twitter.com/fvL7Cz5Tvv

— Lookonchain (@lookonchain) March 11, 2024

The said whale address moved all the 261.6 million USDT to Binance. This was seen as a bullish turn of events, as it shows an expansion in whale buying power, a pattern that regularly prompts a development in asset price.

Also, an increase in stablecoin deposited in exchanges is normally viewed as a bullish sign, as it suggests that participants in the market are hoping to obtain more risk assets, basically bolstering demand.

The 261.6 million that was deposited into Binance was one of the forerunners of the most recent Bitcoin spike above $72,000. Likewise, on-chain information affirms that exchanges have kept on seeing increased inflows of stablecoins regardless of a new drop from past highs.

Read Also: World 10th Largest Asset: Bitcoin Ahead Of Tesla

Consistent Interest And Demands From Investors

One of the variables behind the most recent Bitcoin price is the developing interest from U.S.-based organizations, both in the conventional Bitcoin market and in the spot Bitcoin ETF market. The Coinbase Premium index has seen a marked upsurge lately, demonstrating increased purchasing pressure from U.S. institutional investors.

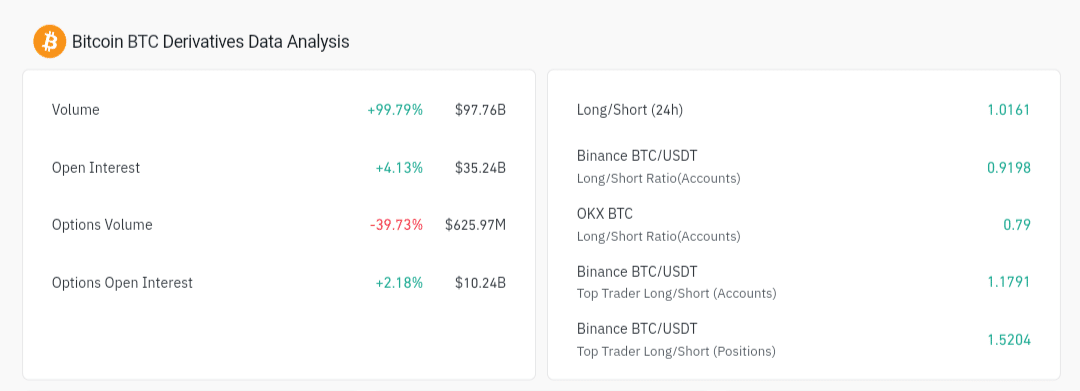

This increase in purchasing pressure can be credited to the bullish atmosphere encompassing the Bitcoin market. In the midst of the bullish atmosphere, information from Coinglas affirms that Bitcoin’s Futures Open Interest (OI) has spiked to $35.2 billion, with a prevalence of long positions, as investors keep on wagering on further price rises.

The $35.2 billion value is the biggest recorded Bitcoin OI ever, this new high has surpassed the previous all-time high of $26 billion on the 1st of March. Bitcoin has kept on pushing toward greater levels, the asset at the hour of composing is trading for $71,955.

Follow us on Twitter, Facebook, Telegram, and Google News.

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.