Solana Price Stalemate: Bullish Flag or Bearish Whales?

Solana (SOL) is caught in a tug-of-war between bullish and bearish signals, leaving investors unsure how to respond.

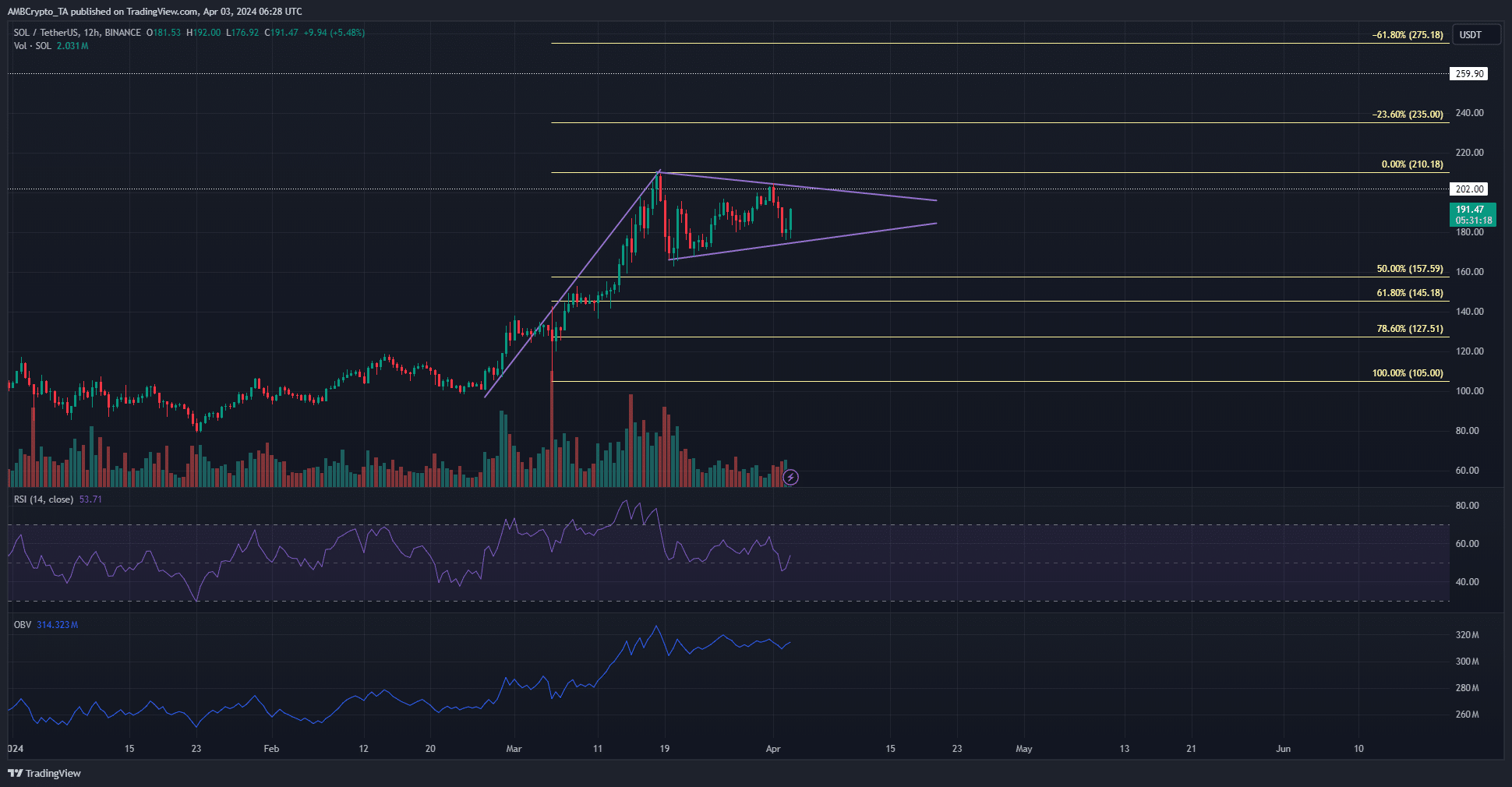

Analysis identified a bullish flag pattern for SOL, suggesting a potential price rally past $200. This technical indicator points towards a breakout following a period of consolidation.

Read Also: XRP Struggles to Regain $1 Glory, Analysts Divided on April Prospects

Dominant Buyers, But Whale Activity Threatens

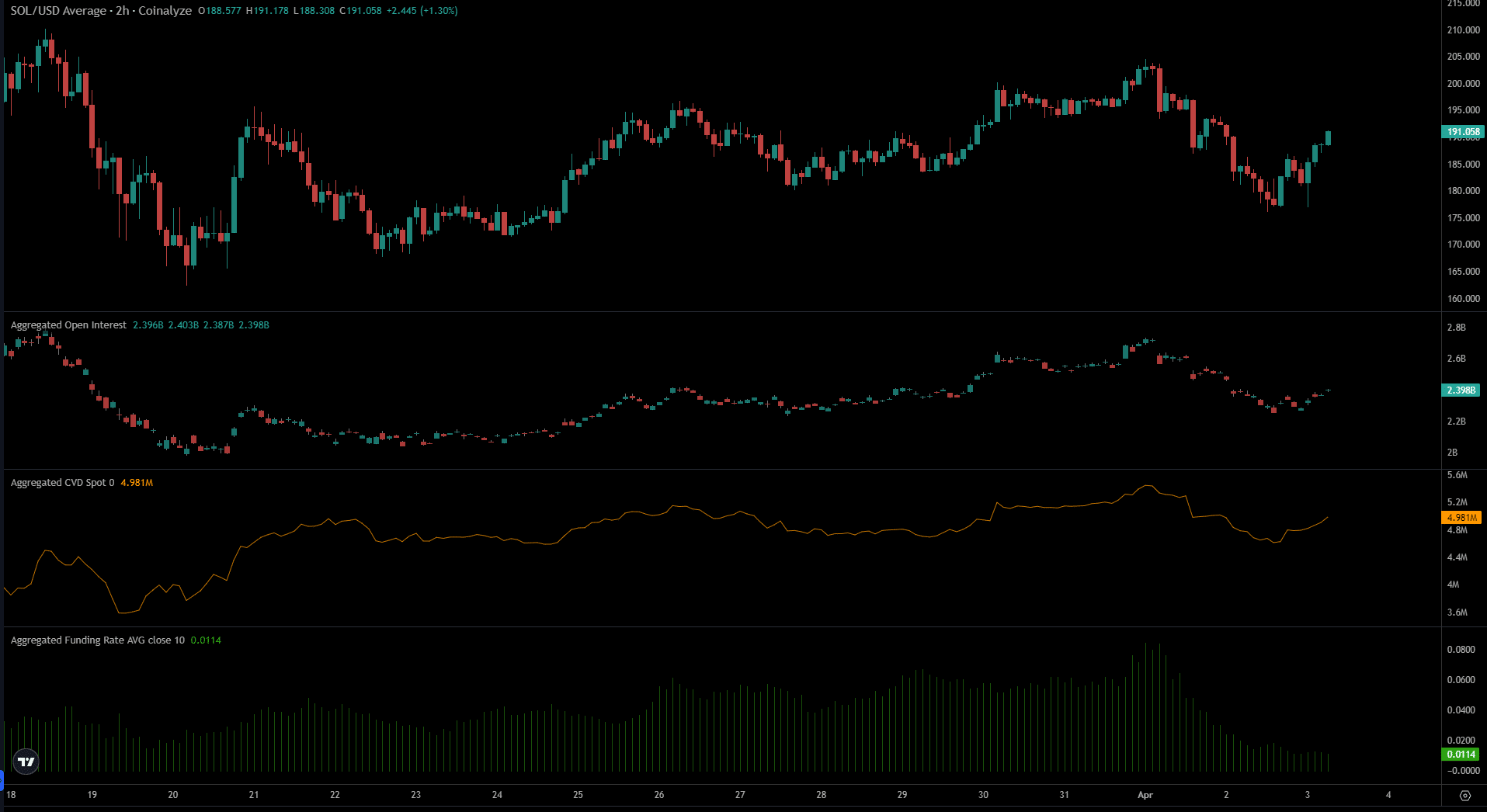

Despite a recent market-wide correction, it was discovered that buyers remain dominant for SOL. However, reports of whales transferring SOL to exchanges raise concerns about increased selling pressure shortly.

The H12 swing low sits at $162.45. A drop below this level would flip the market structure to bearish. Conversely, breaking and retesting the upper trendline of the pennant pattern would confirm a bullish breakout.

Read Also: XRP Underwhelmed in Q1, But Analysts Predict Bullish Run

Volume and Momentum Lack Clarity

Trading volume within the pennant has been declining, while the On-Balance Volume (OBV) remains flat. The Relative Strength Index (RSI) hovers around 50, indicating neither bulls nor bears have the upper hand.

A bullish breakout could propel SOL to $240, aligning with the 23.6% Fibonacci extension level. Resistance above $200 is minimal, potentially leading to a surge towards $260.

Mixed Signals from the Futures Market

Open Interest and funding rates have declined since April 1st as prices dipped. Despite a recent bounce, futures market participants seem hesitant to go long on SOL.

A recent uptick in spot market CVD (Cumulative Funding Rate) suggests a rise in demand, potentially supporting a breakout scenario.

Investor Takeaway

Solana’s price action presents a confusing picture. While the bullish flag pattern and dominant buyers offer promise, whale activity and a lukewarm futures market raise concerns. Investors should exercise caution and conduct their research before making any investment decisions.

Follow us on Twitter, Facebook, Telegram, and Google News

Dr. Olajide Samuel juggles the demands of medical studies with a passion for cryptocurrency. A seasoned blogger, Olajide shares his vast global knowledge of the crypto space, offering insights to enthusiasts. Despite his busy schedule, his commitment to crypto remains strong, and he actively seeks ways to contribute to its future.