Litecoin (LTC) Whales Prevent $75 Downturn, Can We Expect a $90 Comeback?

Litecoin experienced an 8% drop in price within the weekly timeframe, hitting a low of $75.7 on June 11. However, recent whale investor activity suggests a potential early rebound.

Despite significant turbulence in the crypto market this week, Litecoin and Bitcoin have shown greater resilience compared to other projects such as Solana and Ethereum, which are grappling with double-digit losses.

Read Also: Whale Moves 357.2 Billion PEPE Tokens to Binance During Significant Price Drop

On June 11, LTC price plummeted by 11%, but bull traders managed to reverse more than half of these losses by June 14, with the price reaching around $78.9 on June 15, reflecting a 5.10% increase within three days amidst bearish macro market catalysts.

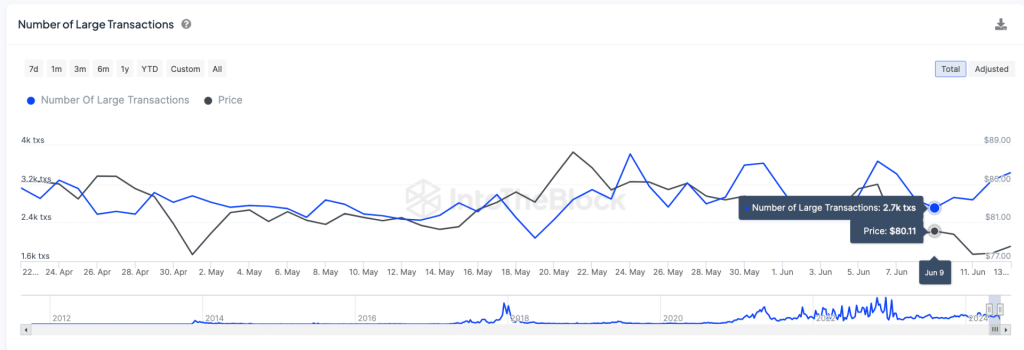

Whale investors have played a key role in driving Litecoin’s resilient performance amid intense market volatility. On-chain data analysis reveals a considerable increase in whale activity on the Litecoin network over the past week, with a 27% surge in large transactions exceeding $100,000.

Increased whale activity during market downtrends is interpreted as a bullish signal, as it provides much-needed market liquidity, aids in boosting confidence among other investors, and helps prevent major price impact caused by panic selling.

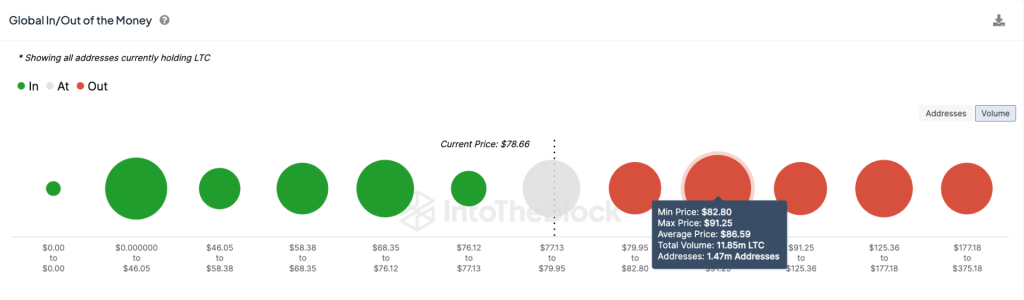

The surge in whale demand explains Litecoin’s relatively more resilient performance compared to other cryptocurrencies during the week. However, it remains to be seen if Litecoin’s bullish momentum can break above the critical resistance at $83 in the upcoming days.

Whale intent to defend the $75 support suggests that Litecoin’s price may consolidate within the $76 to $80 channel in the near future, potentially avoiding major swings.

Read Also: Spot Ether ETF Launch Shifted to July 2nd Amid SEC Feedback

Follow us on Twitter, Facebook, Telegram, and Google News