Whale Offloaded $114M Worth of BTC to Binance, What’s Does this Mean?

Earlier today, a significant Bitcoin transaction caught the attention of the cryptocurrency community. A major Bitcoin entity, known as a whale, moved $114 million worth of Bitcoin to Binance, sparking a drop in Bitcoin’s price to below $63,000. This move has led to speculations about potential further selloffs shortly.

The transfer of 1,800 BTC at 1:40 UTC+8 caused Bitcoin’s value to plummet from $63,800 to $62,900, as reported by Arkham Intelligence. This entity has been highly active in the market, recently withdrawing 6,725 BTC ($437 million) from Binance and OKX, and then returning 3,481 BTC ($217 million) to Binance within the last week at an average price of $62,300. It currently holds 7,867 BTC, valued at roughly $494 million, indicating the potential for increased volatility with potential future transactions.

Market conditions have been further impacted by miner activity, with miners selling over 2,300 BTC (approximately $145 million) in the last 72 hours. This surge in selling pressure follows the fourth Bitcoin halving event, which led to reduced block rewards. Miners are adjusting their strategies to manage potential losses, contributing to increased volatility and downward pressure on Bitcoin’s price.

Read Also: Kronos Leads the Way as the First American Public Company to Embrace Shiba Inu Payments

Impact of German Government Liquidation

The actions of the German government have added another layer of complexity to the market. German authorities recently moved over 1,500 BTC, with $25 million directed to various exchanges such as Coinbase, Kraken, and Bitstamp. Since June, Germany has liquidated over 2,700 BTC. Combined with the U.S. government’s $4,000 BTC sale last month, these significant liquidations have contributed to market uncertainty and intensified the bearish trend.

Market Outlook and Trend

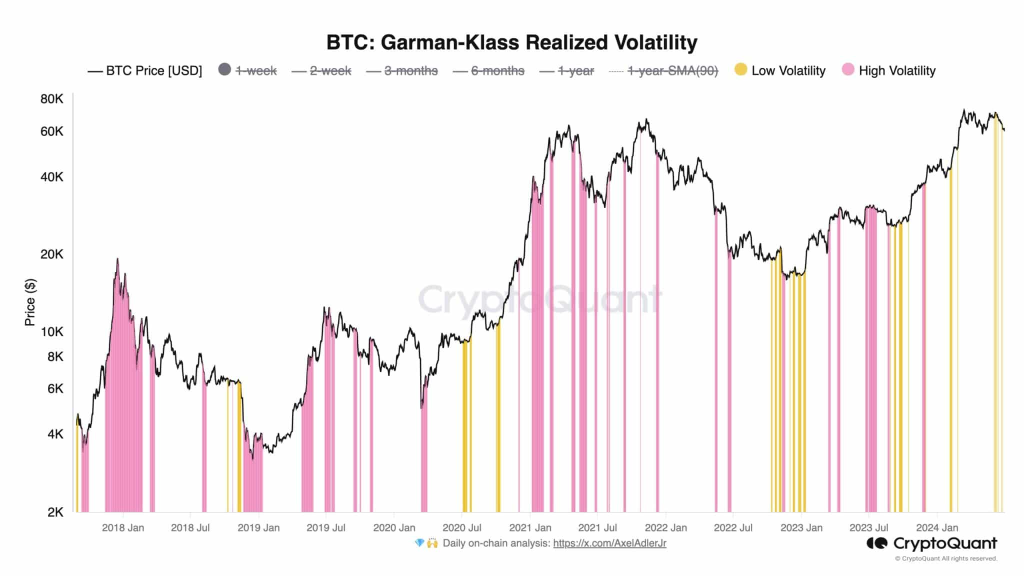

In terms of Bitcoin’s future price, market analysts have provided mixed forecasts. CEO of CryptoQuant, Ki Young Ju, described the current market as “boring” but sees it as a strategic opportunity for large players to accumulate Bitcoin. He maintains that the bull cycle remains intact despite recent selloffs. Historical analysis by Ali Martinez supports a potential rebound, noting that Bitcoin often recovers well in July after a negative performance in June, with historical averages suggesting an 8%-10% gain.

As it Stand

In conclusion, recent market activities from whales, miners, and governments have brought significant volatility to Bitcoin’s market. The large selloff by a Bitcoin entity, along with ongoing miner and government liquidations, has created a turbulent environment. While the immediate outlook sees increased volatility, long-term trends and insights from market analysts hint at potential recovery periods. Stakeholders must navigate this complex landscape, balancing immediate risks with longer-term opportunities.

Read Also: Binance’s 1.7 Billion Terra Luna Classic Burn: What’s Next?

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.