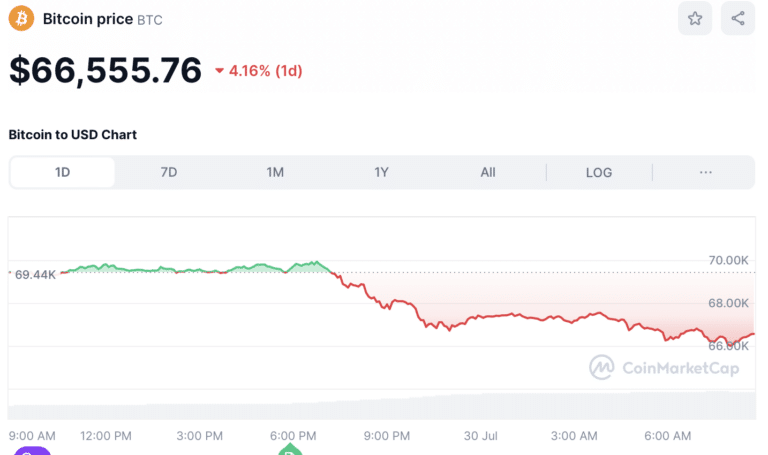

Today’s Crypto Update: Bitcoin Slips to $66,000, While Altcoins Trail Behind

Today, the crypto market saw a bearish trend, with Bitcoin (BTC) dropping to $66K, and Ethereum (ETH), Solana (SOL), and XRP also experiencing declines of 0.7%-6%. The global crypto market cap fell by 3.32% to $2.38 trillion, while the total market volume increased by 72.97% to $83.26 billion.

Bitcoin (BTC) experienced a 4.16% decrease, landing at $66,555.76. There are concerns over a potential BTC transfer by the Mt. Gox address, with recent on-chain data suggesting such activity. Additionally, the U.S. government moved $2 billion worth of seized Bitcoin from the dark web site Silk Route.

Read Also: XRP Community Awaits Verdict: Skyrocketing Prices on the Horizon?

Ethereum Trends

Ethereum (ETH) witnessed a turbulent movement, slipping 0.77% to trade at $3,319.01. The spotlight is on Ethereum staking reaching an all-time high amidst a spot ETF buzz.

Solana Trends

Solana (SOL) declined by 4.94% to $182.54, and the talks about a potential Solana ETF have cooled down, with BlackRock CIO confirming no SOL ETF in the near future.

XRP, Dogecoin and SHIB Trends

XRP fell by 0.92% to $0.601. Dogecoin (DOGE) and Shiba Inu (SHIB) also saw declines. However, Book of Meme (BOME) rallied nearly 11% to $0.01056.

Top Gainers and Losers

The biggest gainers were BOME, MOG Coin (MOG), Bitcoin SV (BSV), and AIOZ Network (AIOZ). Some of the biggest losers included Popcat (POPCAT), Jupiter (JUP), Bittensor (TAO), and dogwifhat (WIF).

On the hourly time frame, BTC gained 0.16% while ETH jumped 0.03%, adding a layer of intrigue to today’s crypto prices.

Read Also: Analyst Foresee Solana Outshining Major Cryptocurrencies, Touted as the Fastest Horse of this Cycle

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.