Shiba Inu Price Drops – Essential Levels to Monitor for a Bullish Turnaround

The Shiba Inu [SHIB] token has faced strong selling pressure and struggled to maintain its bullish momentum after deviating from its 50-day Exponential Moving Average (EMA).

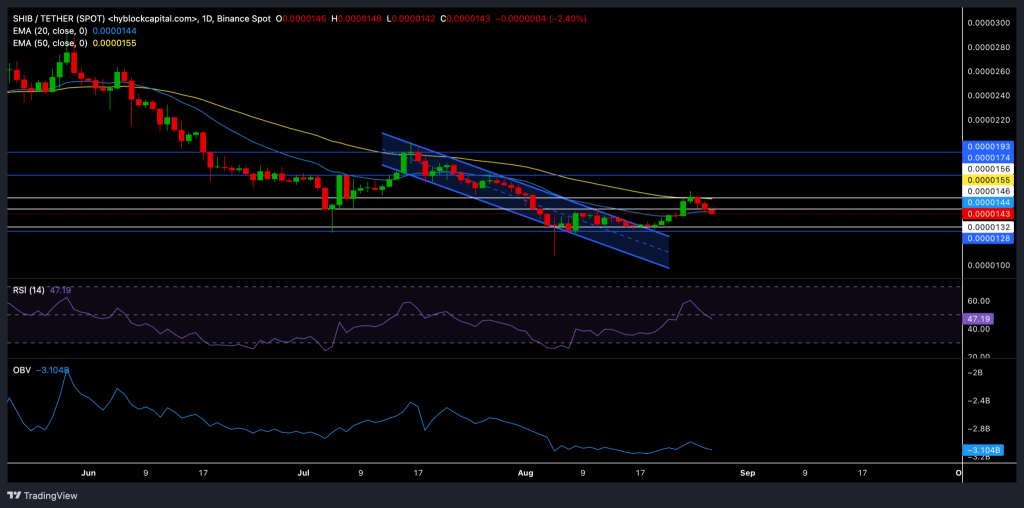

Despite a short-lived uptick, the token’s price movement demonstrated weakness, finding it challenging to stay above short-term moving averages. The daily chart revealed a long-term downtrend for the memecoin, with a recent descent into a descending channel.

50-Day EMA Significant Barrier

A strong rebound from the $0.0000128 support helped SHIB break out of this downtrend channel. However, the 50-day EMA presented a significant barrier, causing a reversal and nullifying the recent gains. At the time of writing, the altcoin was trading at $0.0000144, down almost 2% in the past 24 hours.

Read Also: Evaluating Projects on the Shibarium Ecosystem: Our Perspective

Key moving averages, including the 20 EMA (red) and the 50 EMA (cyan), displayed a slight downward trend, indicating a bearish edge. If the bears persist, a near-term downtrend could emerge. Therefore, it’s important to monitor the support level between $0.0000132 and $0.0000128. A breach below these levels might trigger further declines.

The Relative Strength Index (RSI) hovered around the 47 mark, reflecting a neutral to bearish sentiment. A sustained drop below the midline could escalate selling pressure, pushing SHIB lower. The On-Balance-Volume (OBV) indicator depicted a downward trajectory, signalling greater selling than buying volume. However, a significant OBV rebound could indicate a potential bullish divergence, providing hope for bullish investors.

Traders should be attentive to a potential rebound from the $0.0000132 support level, as a failure to hold this level could lead to a deeper decline. Conversely, a breakout above the $0.0000155 resistance might signal a reversal, propelling SHIB toward the $0.0000174 level in the near future.

Market Sentiment

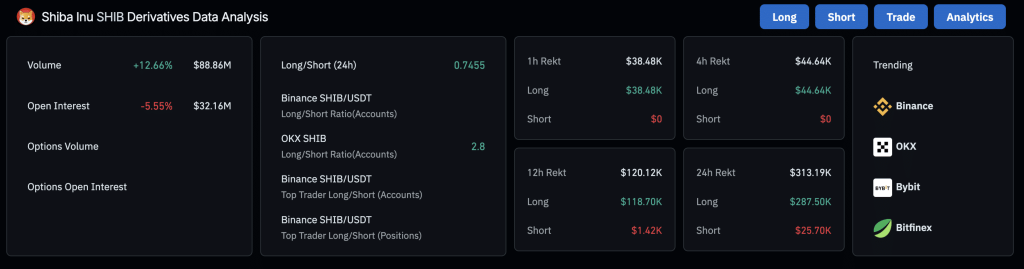

Derivatives data offered additional insights into the market sentiment. The open interest for SHIB decreased by 5.55% to $32.16 million, indicating reduced speculative interest. Although the volume increased by 12.66% to $88.86 million, the overall long/short ratio remained below 1 as per CoinGlass. The 24-hour ratio of 0.7455 suggested a greater number of short positions than longs.

Both the 1-hour and 12-hour liquidation data revealed a higher rate of liquidation for long positions, further supporting the bearish outlook. Monitoring Bitcoin’s movement and overall market sentiment will be crucial in anticipating SHIB’s next moves.

Read Also: Analyst Predicts XRP to $6: Unpacking Elliott Waves and Pennants

Follow us on Twitter, Facebook, Telegram, and Google News

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.