Solana (SOL) Back in the Spotlight: Institutional Appeal and Bullish Momentum

Solana (SOL) is regaining investor confidence, particularly among institutional players. This recent surge has sparked bullish predictions for the asset, with some suggesting a potential extended rally.

Institutional Backing and Market Shift

Solana has consistently attracted institutional interest, and this continues to be a driving force behind its current upswing. The recent gains and change in market sentiment have fueled speculation of an upward trajectory for SOL, although some analysts remain cautious about reaching a new all-time high soon.

Read Also: Ripple CTO Hails Chris Larsen as Company’s Founding Force

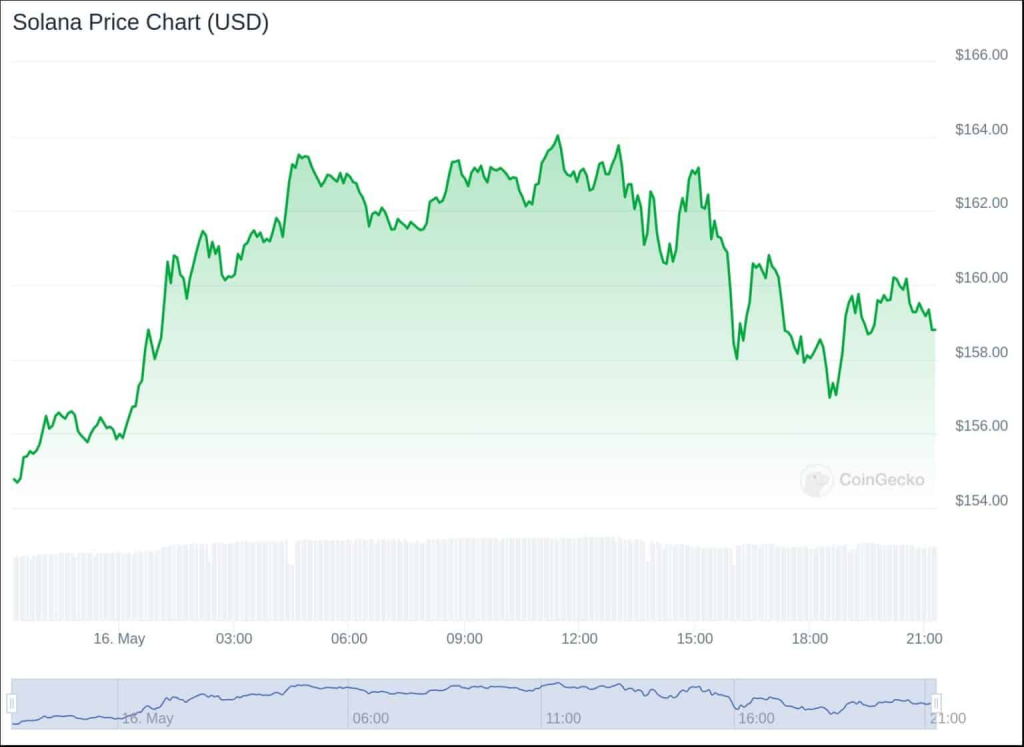

For context, Solana reached its peak of $260 on November 6, 2021, fueled by the broader DeFi (decentralized finance) boom. Currently, SOL sits at $159.2, reflecting a 38% decline from its record high. However, recent positive flows have pushed the price past the $164 mark, despite intraday corrections.

Bullish Signs: Price, Volume, and On-Chain Activity

Solana is known for its ability to outperform the market during recovery periods. This recent uptick is characterized by a positive momentum in price, institutional flows, and on-chain activity. Over the past 24 hours, SOL has climbed 4%, reaching a market capitalization of $71.3 billion. The daily trading volume has also surged by 31% to $3.9 billion, with weekly flows reaching 8.35%.

Read Also: Senate Strikes Down Controversial Crypto Rule in Win for Industry

This sustained uptrend has translated to monthly gains exceeding 20%, igniting a wave of optimism within the Solana community. Furthermore, the total value locked (TVL) across DeFi platforms using Solana has witnessed a 7.83% increase to $4.42 billion. DeFi transaction volumes have also grown by $1.2 billion within the same period. Leading protocols like Jito, Marinade, and Kamino boast a TVL exceeding $1 billion each.

Memecoins and Rate Cuts: Potential Catalysts for Growth?

Some crypto enthusiasts believe that Solana has a knack for capturing market attention. In 2021, it rode the NFT (non-fungible token) wave, and in 2024, memecoins seem to be playing a similar role.

However, analysts remain divided on whether memecoins can propel SOL to a new all-time high in the near future, considering the current interest rate environment. Crypto bulls point to the recent surge in Solana memecoins (up 6.4% in the last 24 hours, with a market cap exceeding $7.5 billion) and a potential Federal Reserve rate cut as factors that could push SOL to a new resistance level.

The influx of new memecoins experiencing significant gains (as high as 50x in daily trading) adds fuel to the bullish projections. Additionally, a potential rate cut by the Fed could incentivize investors to move towards riskier assets like memecoins, further bolstering SOL’s value.

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Raliat: A rising star in the crypto world, blending expertise with a passion for analysis. With a knack for simplifying complex concepts, she empowers audiences to understand and navigate the blockchain landscape. Raliat’s insightful content and analytical prowess make her a trusted guide in the ever-evolving world of cryptocurrency.