Whale Moves 357.2 Billion PEPE Tokens to Binance During Significant Price Drop

A major whale in the cryptocurrency community made a significant move by transferring 357.2 billion PEPE tokens to Binance during a noticeable price downturn. This transaction has sparked discussions about its potential impact on the market and the subsequent implications for PEPE.

Whale Activity

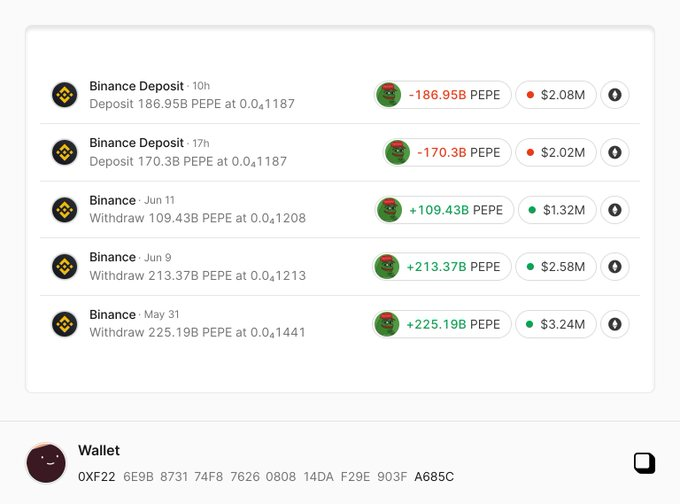

PEPE, has experienced a notable decline of over 10% in the past week according to on-chain data. A prominent holder, identified by the address 0xf22…a685c, has adjusted their position by withdrawing 548 billion PEPE tokens from a centralized exchange at an average price of $0.00001341, equivalent to approximately $7.35 million.

However, within the last 16 hours, the same holder initiated two transfers back to Binance, sending 170.3 billion tokens and 186.95 billion tokens at a lower price of $0.00001157, resulting in a total worth of $4.14 million.

If the tokens were to be sold at the current rate, the holder would incur a loss of $660,000, with the remaining tokens valued at a $320,000 loss. This strategic maneuver hints at the possibility of the whale anticipating further price dips or preparing for new opportunities in the market.

Read Also: Ripple and Archax Expand Partnership to Drive Real-World Asset Tokenization on XRP Ledger

Market Future Outlooks

Presently, PEPE is trading at approximately $0.00001208, and its 24-hour trading volume exceeds $954 million. Nonetheless, the token has experienced a 0.35% decrease in price within a day and a more significant 7.08% decline over the past week. With a circulating supply of 420 trillion PEPE tokens, the total market cap stands at around $5.09 billion. The token’s price ranges between $0.00001217 and $0.00001137. Open interest in PEPE futures has decreased by 8.20%, now valued at $79.1 million.

Technical Analysis market consolidation led to a V-top reversal from $0.00001725, resulting in a 37.2% drop to $0.0000108 and the market cap declining to $4.54 billion. Presently, PEPE’s price is hovering around a potential breakdown from the critical $0.0000114 support level, which aligns with the 50-day exponential moving average and a 38.2% Fibonacci retracement.

Conclusion

Should this support level be breached, it has the potential to heighten selling pressure and potentially drive the price down to $0.000009. The Fibonacci tool identifies $0.000009 and $0.000007 as crucial levels corresponding to the 50% and 61.8% retracements, where buyers may intervene to reverse the downtrend.

Read Also: Spot Ether ETF Launch Shifted to July 2nd Amid SEC Feedback

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.