Solana’s Price Surges Ahead: SOL Expected to Attract $4.5 Inflows

Over the weekend, Solana (SOL) experienced high volatility in the market, reclaiming a significant portion of gains from the previous week. Despite the typically low volume in the crypto market during August, SOL has demonstrated strong potential for a substantial recovery.

Solana Asset Under Management

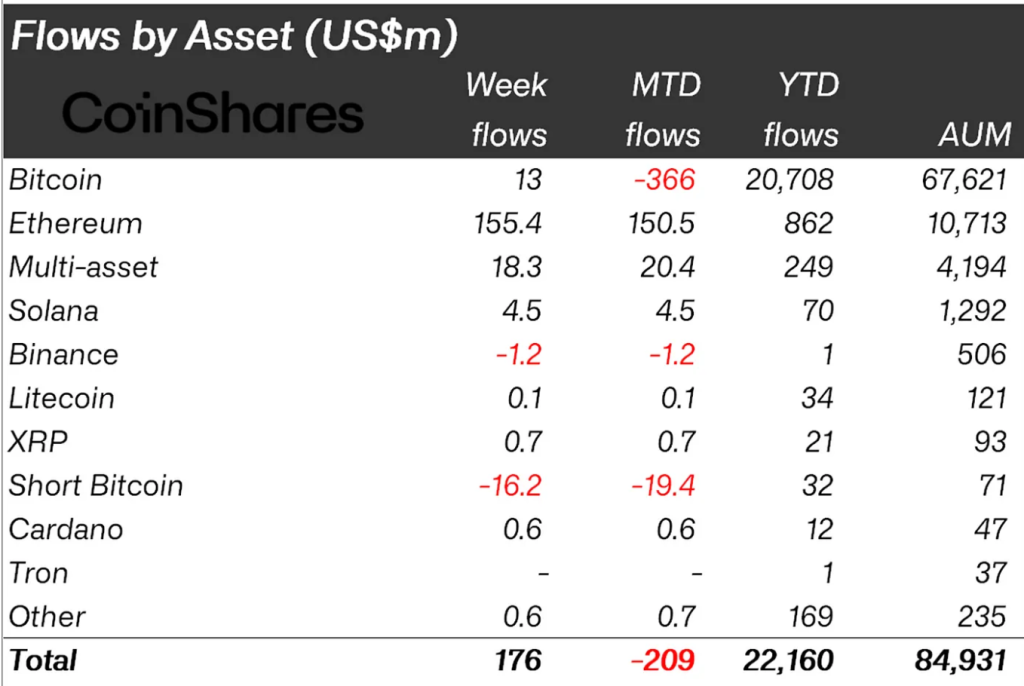

Solana’s assets under management (AUM) grew by $4.5 million, indicating increasing investor interest and confidence in the cryptocurrency. While Solana’s price encountered downward pressure alongside other major cryptocurrencies like Bitcoin, Ethereum, and Ripple, the CoinShares digital asset flows weekly report highlighted a noteworthy influx of $4.5 million into SOL.

This surge reflects investors seizing opportunities during the prior week’s downtrend and expanding their holdings. Furthermore, overall sentiment towards SOL remains bullish, fueled by growing optimism for the potential approval of a spot Exchange-Traded Fund (ETF) before the end of 2024.

Total inflows amounted to $176 million, with Ethereum leading the way with $155 million and Bitcoin following with $13 million. If the inflow trend continues this week, traders can expect SOL’s price to gain momentum and potentially reach $180 and $200.

Read Also: Price Prediction: PEPE Anticipate a Possible 21% Correction Before a Bullish Rebound

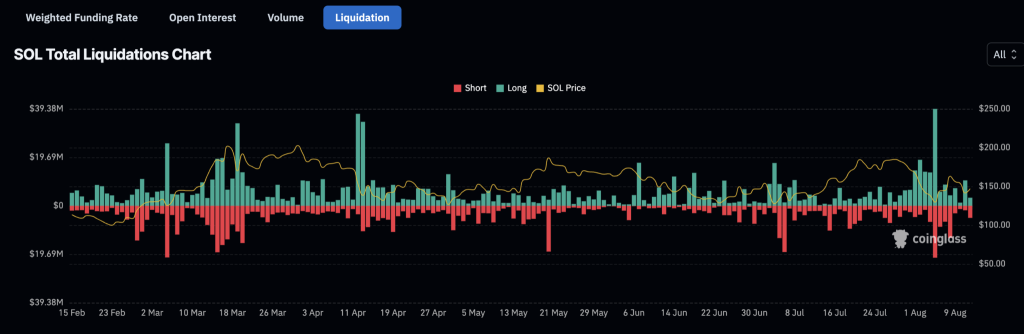

Simultaneously, short-position liquidations are on the rise, with data from Coinglass showing forceful closures of $4.92 million worth of short positions and $3.27 million worth of long positions. An imbalance where short liquidations surpass long liquidations tends to signal bullish momentum. It’s noteworthy that forced buying resulting from liquidated short positions can fuel price rallies, potentially leading to a short squeeze.

From a technical analysis standpoint, Solana’s price has shown signs of a trend reversal after finding support near the $140 level, reinforced by the 200-day Exponential Moving Average (EMA). Market participants anticipate a breach above the $150 level, with potential bullish continuation towards $180.

Key Profit Target

Key profit targets include the confluence resistance at $155, formed by the 20-day EMA and the 50-day EMA, last week’s resistance at $160, and the weekly target of $180. However, this projection advises caution against aggressive buying, given ongoing rumours of VC token unlocks, which can increase the circulating supply and potentially affect price recovery or upward trend continuation.

Moreover, a persistent sell signal from the Moving Average Convergence Divergence (MACD) suggests the prudence of waiting for further confirmation before entering SOL buy orders. In the event that the 200-day EMA support fails to hold, Solana’s price could experience downside movement towards the $130 and $110 levels as it seeks additional liquidity.

Read Also: Solana’s Price Could Dip Due to Decreased On-Chain Activity and Market Retraction

Follow us on Twitter, Facebook, Telegram, and Google News

Kayode Michael is a seasoned cryptocurrency analyst, successful trader, and skilled writer with a strong command of cryptocurrency analysis and price action. He leverages his technical analysis skills to provide valuable insights into emerging market trends and potential opportunities for investors to make informed decisions.