Solana Navigating towards $140 Despite Bearish Trends: What’s Next for SOL?

The recent volatility in the cryptocurrency market has caused a surge in the price of SOL, surpassing $140. This spike in price, however, may not be sustainable as on-chain metrics and network activity for SOL suggest potential bearish trends.

The increase in SOL’s value comes as Bitcoin’s dominance in the crypto market has declined, indicating a shift in investments from BTC to other leading altcoins. The Bitcoin Dominance Index experienced a significant daily drop of over 1.8% on June 25, the largest drop since January.

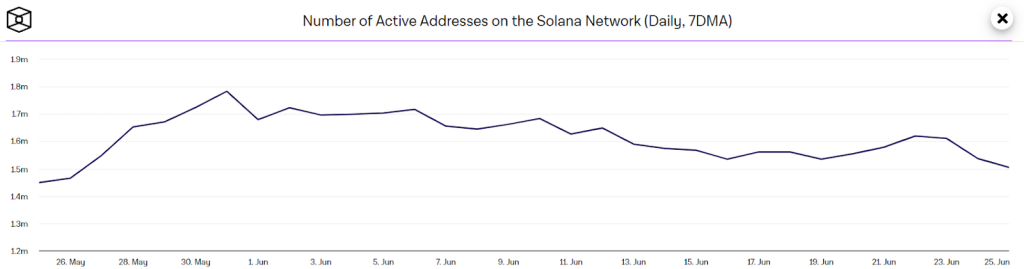

SOL Addresses Shows Decline

Data from Coinglass indicates that approximately $3.7 million worth of SOL was liquidated, with contributions from traders holding long positions as well as sellers. On-chain metrics for SOL over the past five days show a decline in active addresses and new addresses, suggesting reduced user activity and a weaker trading sentiment.

Read Also: Cardano Under Fire: DDoS Attack Exposes Weaknesses of the Attackers!

Despite this, there is positive news as the total value locked (TVL) for Solana’s network has increased to $4.2 billion as of June 26, signaling growing trust and involvement of people and developers in the Solana ecosystem, thus contributing to the price increase.

Looking ahead, SOL has rebounded from $122 and re-entered its descending channel pattern. If bulls can sustain the price above the 100-day EMA at $141, this could lead to a rise towards the resistance line of $159, with potential consolidation in the range of $175-$192. Conversely, a reversal from the 100-day EMA level might see the price drop to the critical support at $122, and further down to $100 if this level is breached.

Read Also: The Future of XRP: Why $500 Will Be a Bargain in 5 Years

Follow us on Twitter, Facebook, Telegram, and Google News

Meet Daniel Abang: Crypto guru, content creator, and analyst. With a deep understanding of blockchain, he simplifies complex concepts, guiding audiences through the ever-changing crypto landscape. Trusted for his insightful analysis, Daniel is the go-to source for staying informed and empowered in the world of cryptocurrency.