Crypto Analyst Flags Financial Warning Signs: Spotlight on OpenAI’s Balance Sheet

In a recent tweet gaining traction in the crypto and tech communities, a well-known analyst highlighted several recurring themes shaping the current macroeconomic and market environment: the unpredictable nature of U.S.-China trade negotiations, unresolved questions around critical metals, an overbuild in data center infrastructure, tightening bank credit—and most notably, concerns over OpenAI’s financial footing.

Read Also: Ripple Acquires GTreasury: A Strategic Leap into the Swift Ecosystem

While each issue carries macroeconomic implications, the analyst emphasized that the only “real worry” lies in OpenAI’s balance sheet, raising questions about the sustainability of one of the most influential AI firms in the world.

Trade Uncertainty and Metal Supply Still Unresolved

Talks between the U.S. and China have entered yet another “on-again, off-again” phase. With tariffs, tech restrictions, and strategic posturing still unresolved, markets continue to react sharply to any policy shifts or diplomatic headlines. Meanwhile, the global demand for critical metals—essential for EVs, semiconductors, and renewable infrastructure—remains mismatched by supply growth. Governments have acknowledged the problem, but few viable solutions have emerged.

These themes, though chronic, are now seen by many investors as “background noise”—persistent but priced in.

Data Center Saturation and Credit Tightening

Another trend noted by the analyst is the rapid expansion of data centers, fueled by AI and cloud computing demand. However, saturation is becoming evident in several regions. The rising costs of energy, land, and water—alongside local opposition—are beginning to challenge the economics of these builds.

At the same time, bank credit is becoming harder to access, particularly for mid-sized enterprises. Post-pandemic monetary tightening and rising defaults have led banks to become more cautious in extending new credit, especially in tech and speculative sectors.

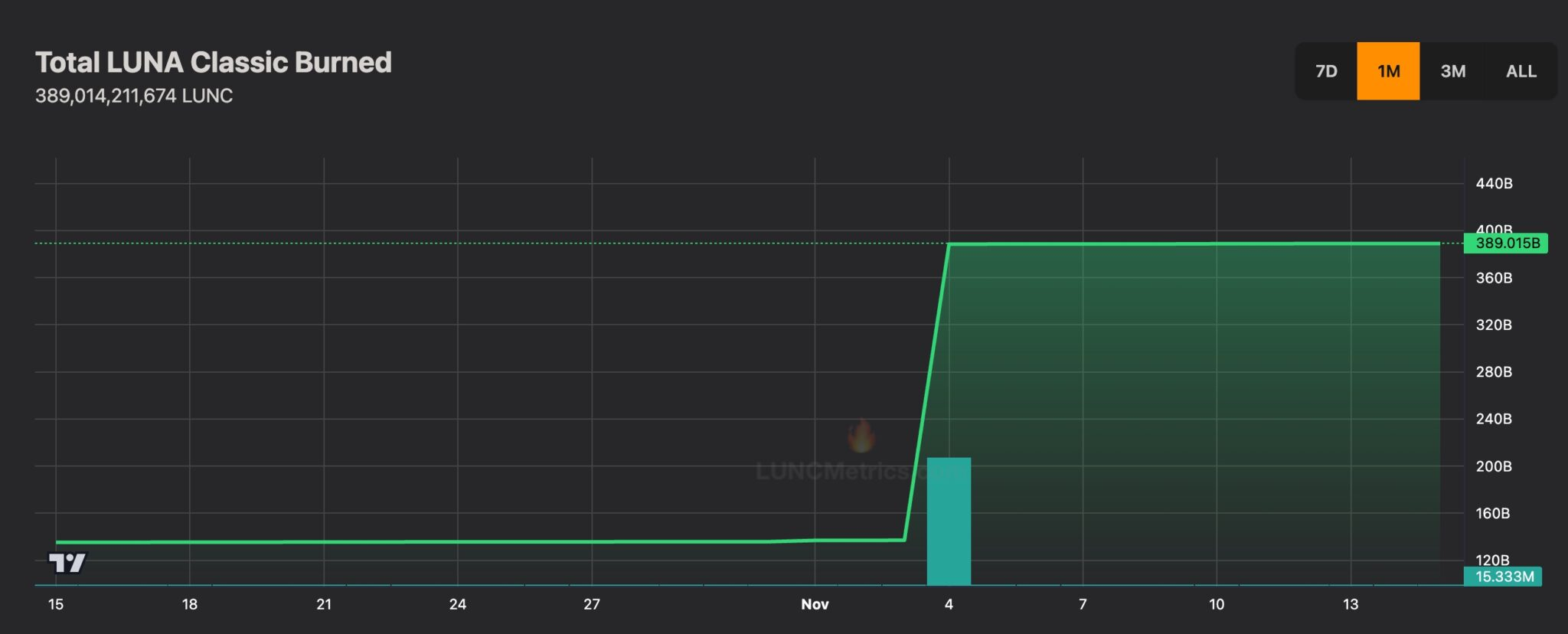

Read Also: LUNC Surges Ahead: Positioning for Top 20 Comeback in the Crypto Market

OpenAI’s Financial Strength Under Scrutiny

Among these issues, the analyst reserved special concern for OpenAI’s financial health. Despite its prominence in the generative AI revolution, the firm is not yet profitable. Publicly available data suggests that OpenAI’s operational costs—driven by large-scale model training, server infrastructure, and R&D—are massive. While Microsoft’s backing provides stability, it’s unclear if OpenAI’s revenue from products like ChatGPT or enterprise APIs is enough to sustain long-term independence without continual fundraising or commercial pivoting.

Conclusion: An Era of Expensive Innovation

As innovation grows more capital-intensive, even giants like OpenAI are not immune to market realities. The analyst’s tweet serves as a reminder: amidst political and industrial noise, it’s the balance sheets that often tell the most critical story.

Follow us on Facebook, Telegram, and Google News.

Cryptolifedigital is a cryptocurrency blogger and analyst known for providing insightful analysis and commentary on the ever-changing digital currency landscape. With a keen eye for market trends and a deep understanding of blockchain technology, Cryptolifedigital helps readers navigate the complexities of the crypto world, making informed investment decisions. Whether you’re a seasoned investor or just starting out, Cryptolifedigital’s analysis offers valuable insights into the world of cryptocurrency.